desenvolvertalentos.online Overview

Overview

How Much Is The Us Capital Gains Tax

Meanwhile, long-term gains are taxed at either 0%, 15%, or 20%. The rate you pay is based on your taxable income. Just like with ordinary income tax rates, the. For example, the rate I assumed above, 37%, was used because some proposals would simply tax capital gains at the top ordinary income tax rate, which now is 37%. How are capital gains taxed? · 20% · $, or more · $, or more · $, or more · $, or more. Economic theory tells us that when the cost of funds goes down, firms will use the opportunity to borrow more funds so that they can increase their. Although there are some exceptions, the act requires a mandatory 15% withholding of the sale price on U.S. property sold or transferred by a foreign national to. In addition to the $, (or $, for a couple) exemption, you can also subtract your full cost basis in the property from the sales price. Your cost. Short-Term Capital Gains Taxes for Tax Year (Due April ) ; Single Filers · $0 - $11, · $11, - $47, · $,+ ; Married, Filing Jointly · $0 -. The maximum capital gains tax rate for individuals and corporations · – · % · same as regular rate. Short-term capital gains are taxed at the investor's ordinary income tax rate and are defined as investments held for a year or less before being sold. Long-. Meanwhile, long-term gains are taxed at either 0%, 15%, or 20%. The rate you pay is based on your taxable income. Just like with ordinary income tax rates, the. For example, the rate I assumed above, 37%, was used because some proposals would simply tax capital gains at the top ordinary income tax rate, which now is 37%. How are capital gains taxed? · 20% · $, or more · $, or more · $, or more · $, or more. Economic theory tells us that when the cost of funds goes down, firms will use the opportunity to borrow more funds so that they can increase their. Although there are some exceptions, the act requires a mandatory 15% withholding of the sale price on U.S. property sold or transferred by a foreign national to. In addition to the $, (or $, for a couple) exemption, you can also subtract your full cost basis in the property from the sales price. Your cost. Short-Term Capital Gains Taxes for Tax Year (Due April ) ; Single Filers · $0 - $11, · $11, - $47, · $,+ ; Married, Filing Jointly · $0 -. The maximum capital gains tax rate for individuals and corporations · – · % · same as regular rate. Short-term capital gains are taxed at the investor's ordinary income tax rate and are defined as investments held for a year or less before being sold. Long-.

Long-term capital gains on investments held for more than a year are taxed at the rate of 0%, 15% or 20%, depending on your taxable income and tax filing status. While the federal long-term capital gains tax applies to all states, there are eight states that do not assess a long-term capital gains tax. They are Alaska. On the other hand, if you had the same $10, profit but you held the asset for more than one year, the tax rate is lower. If you are in the 24% tax bracket. What is the Capital Gains Tax Rate? ; Single. Up to $41, $41,$, More than $, ; Married filing jointly. Up to $83, $83,$, More. General capital gain tax rate is 20%. Tax rate is reduced to 5% in case of supply of residential apartment and the land attached to it or a supply of a vehicle. For single folks, you can benefit from the 0% capital gains rate if you have an income below $44, in Most single people will fall into the 15% capital. State Capital Gains Tax Rates ; 17, New Mexico *, % ; 19, Nebraska, % ; 20, Idaho, % ; 21, Maryland *, %. Capital Gains Tax Rates for · Taxable portions of the sale of certain small business stocks are taxed at a 28% maximum rate. · Net capital gains from selling. Short term gains on stock investments are taxed at your regular tax rate; long term gains are taxed at 15% for most tax brackets, and zero for the lowest two. Long-term capital gains taxes occur when an asset has been sold after being owned for over a year. These taxes can have rates of 0%, 15% or 20% depending on. Capital gains are generally included in taxable income, but in most cases, are taxed at a lower rate. A capital gain is realized when a capital asset is sold or. A flat tax of 30 percent (or lower treaty) rate is imposed on U.S. source capital gains in the hands of nonresident individuals present in the United States for. Hawaii taxes capital gains at a rate of %. Idaho. Idaho taxes capital gains as income, and both are taxed at the same rates. The state income and capital. Let's use our above example of a $90, salary and $10, short-term capital gain. Given the federal income tax rates, and assuming you are filing as a. If your taxable income is above the 15% bracket, you will pay tax on your capital gains at 20%. The thresholds for each tax rate are adjusted annually for. Rather, the states tax capital gains according to the same rates as personal income. The table below summarizes uppermost capital gains tax liabilities by state. Yes, this means that you can pay as little as 0% in federal income taxes on your gains when you sell a long term asset. To determine if the capital gain is. The Washington State Legislature recently passed ESSB (RCW ) which creates a 7% tax on the sale or exchange of long-term capital assets such as. In addition to paying capital gains tax at the federal levels, a majority of U.S. states also have an additional tax rate between % and %. The.

Closing Costs On A 275 000 House

In the United States average closing costs for homeowners are about $3,, though that depends heavily on home price and location. ClosingCorp averaged. For estimated closing costs, the rule of thumb is 3%-6% of the home's purchase price. For a typical Orlando home purchased for $,, that means your closing. We provide an overall closing costs estimate between 2% and 5% of the loan amount. We then factor in some of the most common closing cost charges. Use our free mortgage calculator to find out how much you'll be paying monthly on your home mortgage, including taxes, insurance, PMI and closing costs. Buying mortgage points when you close can reduce the interest rate, which in turn reduces the monthly payment. But each point will cost 1 percent of your. In Australia you would have lots of additional closing costs - Lenders Mortgage Insurance (if you borrow more than 80% of valuation), Government. Most realtors and financial advisors tell you that closing costs will typically be in the range of % of the home value. This may seem reasonable enough, but. Use this calculator to quickly estimate the closing costs on your FHA home loan. Get Current FHA Loan Rates. Closing costs are typically 2% to 4% of the loan amount. They vary depending on the value of the home, loan terms and property location, and include costs such. In the United States average closing costs for homeowners are about $3,, though that depends heavily on home price and location. ClosingCorp averaged. For estimated closing costs, the rule of thumb is 3%-6% of the home's purchase price. For a typical Orlando home purchased for $,, that means your closing. We provide an overall closing costs estimate between 2% and 5% of the loan amount. We then factor in some of the most common closing cost charges. Use our free mortgage calculator to find out how much you'll be paying monthly on your home mortgage, including taxes, insurance, PMI and closing costs. Buying mortgage points when you close can reduce the interest rate, which in turn reduces the monthly payment. But each point will cost 1 percent of your. In Australia you would have lots of additional closing costs - Lenders Mortgage Insurance (if you borrow more than 80% of valuation), Government. Most realtors and financial advisors tell you that closing costs will typically be in the range of % of the home value. This may seem reasonable enough, but. Use this calculator to quickly estimate the closing costs on your FHA home loan. Get Current FHA Loan Rates. Closing costs are typically 2% to 4% of the loan amount. They vary depending on the value of the home, loan terms and property location, and include costs such.

This calculator also makes assumptions about closing costs, lender's fees and other costs, which can be significant. Estimated monthly payment and APR example. Closing Costs. -. Year, Beginning Balance, Total Payment, Principal, Interest, Ending The total cost of home ownership is more than just mortgage payments. Monthly housing expenses. Monthly outlay that includes monthly mortgage payment plus additional costs like property taxes and homeowners insurance, as well as. Each mortgage payment reduces the principal you owe. Interest rate: How much the lender charges you to lend you the money. Interest rates are expressed as. The best guess most estimates will give you is that closing costs are typically between 2% and 5% of the home value. , $1,, $2,, $, , $1,, $2,, $, End Typically, both the interest rates and closing costs are slightly lower than other mortgages. I was told closing costs are between % of sales price (not sure how accurate that may be). When we bought our home we put 3% down (no PMI). Typically, the only closing cost that can be included in an FHA loan is the upfront mortgage insurance premium (upfront MIP). Most other closing costs, such as. The list below shows the closing costs on a home loan amount of $, Closing Cost Charge Loan origination $ Title insurance $ Attorney?s fees $ How much should you budget for closing costs? Closing costs usually range from 2% to 5% of the value of your mortgage and are paid in addition to your down. Closing costs are the fees paid by a buyer and a seller at the time of closing on a real estate transaction. · A buyer usually pays 3% to 6% of the home sale. Use our free Florida mortgage closing costs calculator to quickly estimate your closing expenses on your home mortgage. Includes taxes, insurance, PMI. For estimated closing costs, the rule of thumb is 3%-6% of the home's purchase price. For a typical Orlando home purchased for $,, that means your closing. Typically, both the interest rates and closing costs are slightly lower than other mortgages. To determine the house affordability of a VA loan, please use. , 6/, $, $1,, $, , 7/, $, $1,, $, End of year 23 Closing costs—the fees paid at the closing of a real estate. Using the commercial mortgage calculator; Terms to Know when applying for a commercial real estate loan The closing costs on a commercial investment property. household income of $68, or greater. Recommended Savings. $27, Minimum Down Payment, $19, Closing Costs, $7, Mortgage Amortization Graph. How Much is the Down Payment for a , Dollar Home? · What's the monthly payment for a $, home loan? · Can I afford to buy a k house? · Possible. The Homeownership Assistance Program provides down payment and closing costs assistance to first-time and first-generation homebuyers for the purchase of a.

Keto For Your Body Type

4. Cheese. There are hundreds of types of cheese, most of which are very low in carbs and high in fat, making them a great fit for. Aug 25, - Eat Healthy. Train Hard. Feel Comfortable Subscribe and Get 7 Days Keto Menu for FREE Featured Posts Latest Posts. The ketogenic (or “keto”) diet offers the kind of dietary switch-up that can produce results such as quick weight loss and increased energy. Ketones and ketoacids are alternative fuels for the body that are made when glucose is in short supply. They are made in the liver from the breakdown of fats. Photo by Total Shape on Unsplash Many people choose to eat a Ketogenic diet for its amazing weight loss benefits. It's well known that the Keto diet helps. By shifting the body's fuel source from carbohydrates to fats, the KETO diet allows endomorphs to finally access their stored fat reserves. Some people encourage ketosis by following the ketogenic, or keto, diet. This diet, which is very low in carbohydrates, aims to burn fat by forcing the body to. The diet forces the body to burn fats rather than carbohydrates. A test strip is compared with a colour chart that indicates the degree of ketonuria. Testing. Has low carb tolerance so should be very careful to limit carbs if the goal is weight loss or maintenance. Veggies and/or fruits (~ serving ratio) should. 4. Cheese. There are hundreds of types of cheese, most of which are very low in carbs and high in fat, making them a great fit for. Aug 25, - Eat Healthy. Train Hard. Feel Comfortable Subscribe and Get 7 Days Keto Menu for FREE Featured Posts Latest Posts. The ketogenic (or “keto”) diet offers the kind of dietary switch-up that can produce results such as quick weight loss and increased energy. Ketones and ketoacids are alternative fuels for the body that are made when glucose is in short supply. They are made in the liver from the breakdown of fats. Photo by Total Shape on Unsplash Many people choose to eat a Ketogenic diet for its amazing weight loss benefits. It's well known that the Keto diet helps. By shifting the body's fuel source from carbohydrates to fats, the KETO diet allows endomorphs to finally access their stored fat reserves. Some people encourage ketosis by following the ketogenic, or keto, diet. This diet, which is very low in carbohydrates, aims to burn fat by forcing the body to. The diet forces the body to burn fats rather than carbohydrates. A test strip is compared with a colour chart that indicates the degree of ketonuria. Testing. Has low carb tolerance so should be very careful to limit carbs if the goal is weight loss or maintenance. Veggies and/or fruits (~ serving ratio) should.

Find Your Body Type: desenvolvertalentos.online Dr. Berg discusses what to eat according to your body type to get healthy and lose weight. The Healthy Keto Plan is a revised and improved version of the best-selling book from Dr. Berg, The New Body Type Guide. This book will help you overcome a. A ketogenic diet is a special type of diet that causes the body to make ketones. The diet is very high in fat, and very low in carbohydrates. A ketogenic diet is low in carbohydrates, moderate in protein and high in fat. This type of eating style has become increasingly popular for weight loss in. Here's the truth: For most people, body type eating isn't necessary or important. For them it's just not the most effective tool for their needs and goals. This type of diet can offer many benefits, as it relies on a high-fat, low-carb diet for weight loss purposes. When performed correctly, your body may enter. Can body type—whether ectomorph, mesomorph, or endomorph—determine what sports suit you best, as well as what you should be eating to fuel your activities? A keto diet prioritizes fats and proteins over carbs. It may help reduce body weight, acne, and the risk of cancer. Learn about the benefits and risks here. A low-carb diet is generally used for weight loss. Some low-carb diets may have health benefits beyond weight loss, such as lowering your risk of type 2. The "classic" ketogenic diet is a special high-fat, low-carbohydrate diet that helps to control seizures in some people with epilepsy. It takes about three weeks of carbohydrate elimination for your body to transition into ketosis. The keto diet allows many people to eat the types of high-fat. Ectomorphs do well with a higher carbohydrate keto diet, while mesomorphs can either take the targeted keto diet or the high-protein keto diet. 4. Cheese. There are hundreds of types of cheese, most of which are very low in carbs and high in fat, making them a great fit for. Eating For Your Body Type | ENDOMORPHS Gauge Girl Training · Comments #ketodiet #weightloss #ketosis Thanks for watching! I hope this video helps you understand more about body types and what to for your body type. Ketogenic is a term for a low-carb diet. The ketogenic diet is a diet that produces reactions in the body similar to those that occur during fasting. 4 Keto Diets Defined · 1. Standard Ketogenic Diet (SKD): Beginner. Low carbs, moderate protein, high fat; fat types can include saturated fat or poly- or. The key to entering ketosis is to limit your carbs. Keeping carbs low keeps the hormone insulin low, which in turn facilitates the burning of body fat. Some people encourage ketosis by following the ketogenic, or keto, diet. This diet, which is very low in carbohydrates, aims to burn fat by forcing the body to. Ketones are a type of chemical that your liver produces when it breaks down fats. Your body uses ketones for energy typically during fasting, long periods of.

Best Pool Loan Companies

Companies may also be less inclined to negotiate on the pool's price loan is an entirely new mortgage on top of your existing one. How to choose. HFS Financial is your premier ally for the best pool loan for your upcoming project. With over six decades of industry-leading experience, we are here to help. SoFi: Best overall. · LendingPoint: Best for fair credit. · Upgrade: Best for small loans. · Prosper: Best for peer-to-peer lending. · LightStream: Best for long. With more than 40 years of experience specializing in pool loans and with over , satisfied customers, Lyon Financial's unique relationships with lenders. Yes, banks, online lenders and credit unions offer personal loans for swimming pools. The best loan for a swimming pool has payments that fit into your budget. Best Pool Loans ; LightStream, % - %, % ; Discover, % - %, % ; Upgrade, % - %, % – %. Best pool loan lenders at a glance · BHG Financial: Best for large loan amounts · Discover: Best for small loan amounts · LightStream: Best for excellent-credit. From researching lenders and understanding loan options, to navigating credit requirements and finding the best deals; there's definitely some work involved. For over 45 years, Lyon Financial has provided personalized, hassle-free financial solutions to bring backyard dreams to life. Companies may also be less inclined to negotiate on the pool's price loan is an entirely new mortgage on top of your existing one. How to choose. HFS Financial is your premier ally for the best pool loan for your upcoming project. With over six decades of industry-leading experience, we are here to help. SoFi: Best overall. · LendingPoint: Best for fair credit. · Upgrade: Best for small loans. · Prosper: Best for peer-to-peer lending. · LightStream: Best for long. With more than 40 years of experience specializing in pool loans and with over , satisfied customers, Lyon Financial's unique relationships with lenders. Yes, banks, online lenders and credit unions offer personal loans for swimming pools. The best loan for a swimming pool has payments that fit into your budget. Best Pool Loans ; LightStream, % - %, % ; Discover, % - %, % ; Upgrade, % - %, % – %. Best pool loan lenders at a glance · BHG Financial: Best for large loan amounts · Discover: Best for small loan amounts · LightStream: Best for excellent-credit. From researching lenders and understanding loan options, to navigating credit requirements and finding the best deals; there's definitely some work involved. For over 45 years, Lyon Financial has provided personalized, hassle-free financial solutions to bring backyard dreams to life.

It's nice to have a loan company that will reward and trust you for having good credit. /Top Navigation Menu/Home Improvement/Swimming Pool. Truist Logo. Do. No Impact on Credit to Apply · % Personal and unsecured Loans · Every $75k as low as $/month · Every $k as low as $/month · Fixed Rates as Low as %. Need pool financing? Check offers for the best swimming pool loans with Acorn Finance. Prequalify for up to $k with APR as low as % today! Anthony & Sylvan partners with lenders who offer financing on new pools. Securing a Home Equity Line of Credit (HELOC) is another option for your backyard. SoFi is the best provider of unsecured swimming pool loans because it offers competitive rates, high loan maximums, and quick processing times. Because a pool can add value to your home, banks and other lenders often look favorably upon pool financing. How can I find the best financing option for my. Latham Pools has partnered with Lyon Financial and LightStream as preferred lenders. Learn more about these options and apply today: Lyon Financial Pool Loans. Best Credit Repair Companies · Best Credit Cards · View All · Financial Terms What Factors Do Lenders Consider When Evaluating Loan Applications for Pool. Viking Capital recommends consulting with a financial professional regarding your financing decisions and with pool professionals regarding pool options. To. LightStream delivers a revolutionary swimming pool loan experience that allows customers to focus on their home improvement purchase, rather than on their. Best pool loans · SoFi: Best overall · Upgrade: Best for fair credit · Universal Credit: Best debt consolidation loans for bad credit · LightStream: Best home. Pool Financing · Lyon Financial · Frost Bank · Viking Capital · EECU - Educational Employees Credit Union · Certified Funding, L.P. · Central Bank/LightStream. Viking Capital acts in the capacity of consultant, working with contractors nationwide to help pair pool buyers with the best swimming pool financing options. Blue Haven offices provide access to an exclusive national network of lenders. Each lender provides pool loans (on approved credit) in all or nearly all U.S. Premier Pools & Spas, the top pool builder in the U.S., with a strong presence in over 30 states, partners with the best financial institutions that offer low. With the lowest rates, terms up to 30 years, and more than , satisfied customers across the United States, Lyon Financial combines exceptional financing. With experienced and professional staff, Lyon Financial has the knowledge and experience working with contractors and homeowners so you get the best possible. Pool Loans, Financing, Company, Options & The Best Way To Finance A Pool. Partnered with national Swimming pool installation contractors in every state. HFS Financial offers the easiest home improvement financing and swimming pool loans with up-front funding. You Dream It, We Finance It. Best Pool Loans ; LightStream, % - %, % ; Discover, % - %, % ; Upgrade, % - %, % – %.

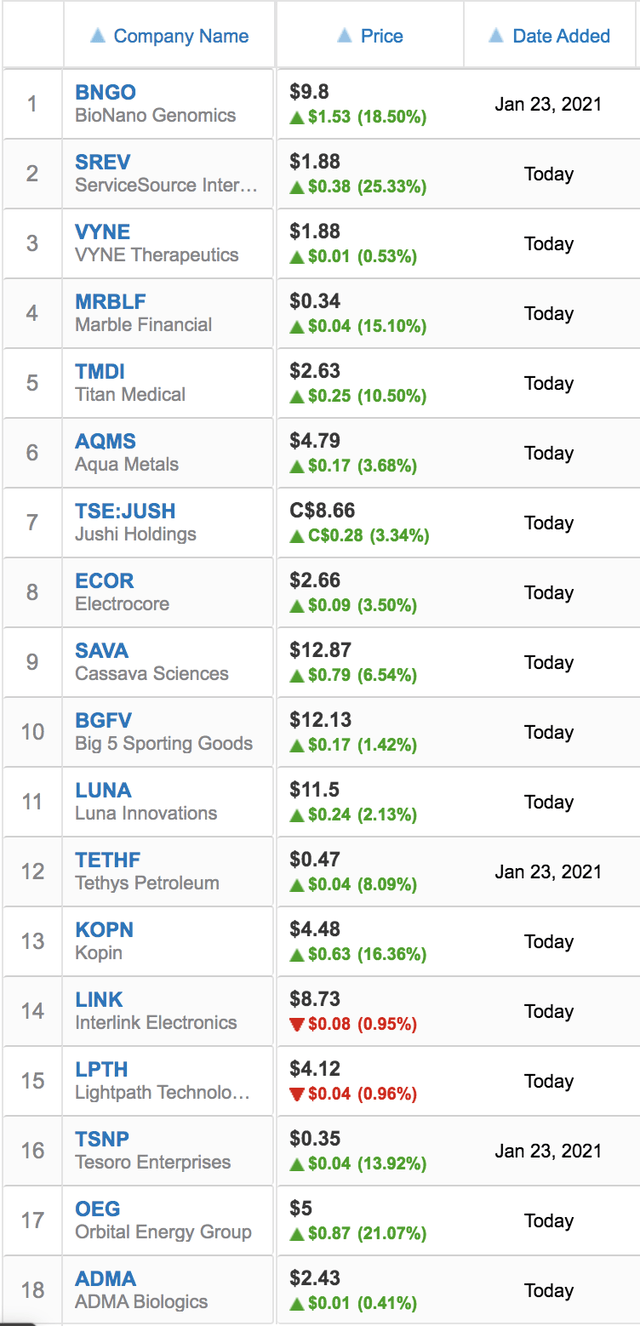

Best Stocks Under 15 Dollars

Looking for good, low-priced stocks to buy? Every day, the financial experts at Benzinga identify the best stocks to buy now under $5. Yes, there are penny stocks on Nasdaq. Generally, a penny stock is a stock that trades for under $5 per share. The Nasdaq has rules and criteria that companies. Looking for higher premiums on stocks $15 and under. I understand that's a hard bid. Just curious what others have to say. US stocks in the list below are the most volatile in the market. They're sorted by daily volatility and supplied with important metrics. Stocks Under $10 ; Avalo Therapeutics Inc AVTX · $ ; Tenon Medical Inc TNON · $ ; SmartKem Inc SMTK · $ ; Aurora Mobile Ltd - ADR JG · $ ; Vaccinex Inc. Best stock for trading options: [1] Futu Holdings [2] Netflix [3] Upstart [4] Moderna [5] Mohawk Industries [6] Apple [7] Nvidia. Stocks: 15 20 minute delay (Cboe BZX is real-time), ET. Volume reflects consolidated markets. Futures and Forex: 10 or 15 minute delay, CT. Market Data powered. Data delayed 15 minutes unless otherwise indicated (view delay times for all exchanges). RT=Real-Time, EOD=End of Day, PD=Previous Day. Market Data powered. If your looking around 15 dollars, I have found Sunrun inc quite volatile. It just skied this week from to 17 bucks. I had shares. Looking for good, low-priced stocks to buy? Every day, the financial experts at Benzinga identify the best stocks to buy now under $5. Yes, there are penny stocks on Nasdaq. Generally, a penny stock is a stock that trades for under $5 per share. The Nasdaq has rules and criteria that companies. Looking for higher premiums on stocks $15 and under. I understand that's a hard bid. Just curious what others have to say. US stocks in the list below are the most volatile in the market. They're sorted by daily volatility and supplied with important metrics. Stocks Under $10 ; Avalo Therapeutics Inc AVTX · $ ; Tenon Medical Inc TNON · $ ; SmartKem Inc SMTK · $ ; Aurora Mobile Ltd - ADR JG · $ ; Vaccinex Inc. Best stock for trading options: [1] Futu Holdings [2] Netflix [3] Upstart [4] Moderna [5] Mohawk Industries [6] Apple [7] Nvidia. Stocks: 15 20 minute delay (Cboe BZX is real-time), ET. Volume reflects consolidated markets. Futures and Forex: 10 or 15 minute delay, CT. Market Data powered. Data delayed 15 minutes unless otherwise indicated (view delay times for all exchanges). RT=Real-Time, EOD=End of Day, PD=Previous Day. Market Data powered. If your looking around 15 dollars, I have found Sunrun inc quite volatile. It just skied this week from to 17 bucks. I had shares.

Best Dividend Stocks. Popular · Best High Yield Dividend Stocks · Dividend +%, 1,,, %, %, , Oct 15, 5. 5. AAPL. $, That you gained 22 cents is also good. But was that just because the market as a whole went up. Did your stock go up on a day when the market as. The Best Stocks Under $1 at a Glance ; CVE: INX. $ $11,4m. 5, ; NASDAQ: SESN. $ $m. , Stocks · IPOs · Mutual Funds · ETFs · Options · Bonds · Commodities · Currencies Intraday data delayed at least 15 minutes or per exchange requirements. The best cheap stocks to buy · Alight · Amcor · Arcadium Lithium · Kosmos Energy · Valley National Bancorp · Related content. Looking for higher premiums on stocks $15 and under. I understand that's a hard bid. Just curious what others have to say. Many penny stocks are from new companies with a micro market cap of under $ million. You can search here for analysts' top-rated penny stocks. read more. Safe High Dividend Stocks: 15+ Strong Picks. Therefore So, they tend to fly under the radar compared to a lot of top stocks that are household names. The exchanged-traded fund with $ billion in assets under management has an expense ratio of %. Have a look at all the stocks in S&P Dividend. Best Monthly Dividend Stocks · Aegeon NV (NYSE: AEG | EURONEXT: AEG) · United Microelectronics (NYSE: UMC) · Itaú Unibanco Holding SA (ADR) (NYSE: ITUB) · Pearson . The Top 10 High-Yielding Dividend Small Cap Stocks Under $ Finding small cap companies that pay dividends is no easy feat. At this stage in a company's. This page lists cheap stocks that have a share price of $ (20 dollars) #15 - Mereo BioPharma Group. NASDAQ:MREO. Stock Price: $ (-$). Market. Cheap Stocks Under $10 ; Clover Health Investments. |CLOV. ++ ; Coursera. |COUR. ++ ; desenvolvertalentos.online |LZ. Best Penny Stocks Under $ Right Now · #1 - Lucid Diagnostics · #2 - Unicycive Therapeutics · #3 - Beyond Air · #4 - Dragonfly Energy · #5 - Cue Biopharma · #6 -. Read our Advertiser Disclosure. Chetan Shekar. Contributor, Benzinga. September 15, If you're interested in exploring more stocks under $1 with dividends. Top 10 Stocks. Other Services. Method for Trading · Research Wizard · Zacks NASDAQ data is at least 15 minutes delayed. This site is protected by. Stocks · Standout Stocks · Top Stocks Under $10 · TTM Squeeze · Warren Buffett Stocks · World Markets Stocks: 15 minute delay (Cboe BZX data for U.S. equities. Shares Under Rs: Check out the list of stocks to buy under Rs that are likely to turn profitable and start investing only at 5paisa. What can happen when the covered call matures? Here are possible scenarios: The shares' current price becomes less than the strike price. The choice expires. Best Stocks for Day Trading – Consistent Big Dollar Movers. The following Trade for minutes per day (trade longer if you wish). The Price.