desenvolvertalentos.online News

News

Merchant Rates

In this post, we'll break down the components of transaction fees to demystify who gets paid what for every payment transaction—and how that's determined. Overview Pass through fees are fees assessed to acquiring banks by the Payment Card Networks (Visa, MasterCard, Discover, and American Express) which are then. Standard rate for receiving domestic transactions ; APM Transaction Rates Apply · % + fixed fee · % + fixed fee · % + fixed fee. “Merchant fees” refers to the processing costs for credit card and debit card transactions made by customers. Standard rate for receiving domestic transactions ; APM Transaction Rates Apply · % + fixed fee · % + fixed fee · % + fixed fee. In this post we'll explain more about the different types of credit card merchant fees, the pros and cons of each, and help you determine which is best for you. It's difficult to give an estimate of what you can expect to pay in credit card merchant fees, but the average credit card merchant fees range between % and. Accepting credit card payments can be costly due to transaction fees. With Elavon you can implement convenience fees or service fees to help offset the. A merchant discount rate is a type of fee that payment processors charge on debit card and credit card transactions. Merchant discount rates are usually between. In this post, we'll break down the components of transaction fees to demystify who gets paid what for every payment transaction—and how that's determined. Overview Pass through fees are fees assessed to acquiring banks by the Payment Card Networks (Visa, MasterCard, Discover, and American Express) which are then. Standard rate for receiving domestic transactions ; APM Transaction Rates Apply · % + fixed fee · % + fixed fee · % + fixed fee. “Merchant fees” refers to the processing costs for credit card and debit card transactions made by customers. Standard rate for receiving domestic transactions ; APM Transaction Rates Apply · % + fixed fee · % + fixed fee · % + fixed fee. In this post we'll explain more about the different types of credit card merchant fees, the pros and cons of each, and help you determine which is best for you. It's difficult to give an estimate of what you can expect to pay in credit card merchant fees, but the average credit card merchant fees range between % and. Accepting credit card payments can be costly due to transaction fees. With Elavon you can implement convenience fees or service fees to help offset the. A merchant discount rate is a type of fee that payment processors charge on debit card and credit card transactions. Merchant discount rates are usually between.

Bank of America's Merchant Services offer seamless payment processing services and solutions so you can spend time on what matters most - growing your. Our rates of % and $ per transaction above Interchange (including AVS!) are some of the lowest out there. Pricing for eCommerce merchant services. This list of merchant service fees for business accounts might seem overwhelming, but it's part and parcel of running a business. The merchant discount rate (MDR) is a fee that merchants and other businesses must pay to a payment processing company on debit or credit card transactions. The merchant discount rate, or MDR, is the rate charged to a merchant for the payment processing of debit and credit card transactions. The service is set. The merchant discount rate, or MDR, is the rate charged to a merchant for the payment processing of debit and credit card transactions. The service is set. Merchant Service. Rates. iStock_Medium. Eliminate Your Credit Card Processing Fees. Our Cash Discount Program is a revolutionary payment platform. Helcim offers affordable processing fees for credit & debit card processing with our Interchange Plus Pricing model. Start saving today. Credit card merchant fees include transaction fees as well as charges for one-off or monthly payments. U.S. merchants who accepted those cards as payment for goods and services paid $ billion in processing fees, an increase of % from the prior year. Standard per-transaction chargeback fees apply ($ USD, $ CAD, £10 GBP, €15 EUR, $20 AUD, and $20 NZD). Visa provides its partners with insight into the Visa Rules. Learn about merchant credit card processing fees, interchange rates, and rules for partners. Credit card merchant fees are split between multiple key players- merchants, credit card networks, banks, and processors. % + 10¢ Tap, dip or swipe % + 10¢ Manually keyed in transactions or payment links % + 25¢ E-commerce Monthly fee starting at $ Understanding Merchant Discount Rate (MDR) and interchange fees. Merchant Discount Rate (MDR) is a fee charged by acquirers for card payment processing services. Credit card merchant fees are split between multiple key players- merchants, credit card networks, banks, and processors. Assessment fees. Assessment fees are charged by the cardmember associations for various expenses including fraud prevention and network operations, and merchant. We offer a low merchant rate, with fixed margins of % and $ per transaction above Interchange for storefront payment processing fees. Interchange fees are one component of the Merchant Discount Rate (MDR) established by acquirers, which is paid by merchants to acquirers in consideration for. The Merit 1 Consumer Loan rate requires a Mastercard approved and assigned Merchant Note: Regulated rates also apply to any U.S. Interregional transaction.

Said Mba Acceptance Rate

Our current class has a median GMAT score of All sections of the GMAT must be taken in order to be considered valid; Official online scores must be. Cost of MBA Report Careers In Finance Guide MBA Scholarships Guide accepted onto the Oxford MBA: 1. Assess your fit. Oxford is an incredibly. The Oxford MBA at Saïd Business School has an acceptance rate of about 20%, making it highly competitive. Applicants need strong academics, leadership. What can you study at Oxford University Saïd School of Business? Currently ranked as the Best Business School by the Times Higher Education awards, it's also. Ranking criteria ; Overall ; Academic Reputation ; Citations per Paper ; Employer Reputation ; H-index Citations. Saïd Business School is one of the top universities in Oxford, United Kingdom. It is ranked #=1 in World University Rankings - Masters In Finance The 25% acceptance rate is in line with the rates at the Top US B-schools (based on USNews Rankings). The cohort of students on the MBA course. The school was ranked 26th in the Financial Times Global MBA rankings. Saïd Business School Class of Key Statistics Entering Full-Time MBA Students. Acceptance Rate. Average GMAT. 4. Average GPA. FT Ranking. Employment Data for Oxford Said MBA Alumni. Percent of Hires in Each Industry: Financial. Our current class has a median GMAT score of All sections of the GMAT must be taken in order to be considered valid; Official online scores must be. Cost of MBA Report Careers In Finance Guide MBA Scholarships Guide accepted onto the Oxford MBA: 1. Assess your fit. Oxford is an incredibly. The Oxford MBA at Saïd Business School has an acceptance rate of about 20%, making it highly competitive. Applicants need strong academics, leadership. What can you study at Oxford University Saïd School of Business? Currently ranked as the Best Business School by the Times Higher Education awards, it's also. Ranking criteria ; Overall ; Academic Reputation ; Citations per Paper ; Employer Reputation ; H-index Citations. Saïd Business School is one of the top universities in Oxford, United Kingdom. It is ranked #=1 in World University Rankings - Masters In Finance The 25% acceptance rate is in line with the rates at the Top US B-schools (based on USNews Rankings). The cohort of students on the MBA course. The school was ranked 26th in the Financial Times Global MBA rankings. Saïd Business School Class of Key Statistics Entering Full-Time MBA Students. Acceptance Rate. Average GMAT. 4. Average GPA. FT Ranking. Employment Data for Oxford Said MBA Alumni. Percent of Hires in Each Industry: Financial.

Oxford Said MBA Program costs $, total. In addition, you will need an additional $30, per year for room and board (living expenses). How many years of. Undoubtedly, Saïd business school had secured a place in the list of Top B-schools, and candidates around the world come to pursue their MBA in this B-school. General. Alumni network rank, Audit year * · Career progression. Aims achieved (%), Career progress rank · Programme assessment. ESG and net zero teaching. Acceptance rate is around one in four. School review each application individually and holistically, so we at General Education advise candidates not to focus. Our Masters of Business Administration (MBA) programme builds on this legacy, providing you with a solid foundation in core business principles. The ranking is crucial for students looking for an education and a brand that carries weight in their post-MBA careers. 2. Duration. The LBS MBA program takes. Explore the Oxford MBA programs, fee, eligibility, costs, rankings, and application process. Get expert support from GOALisB consultants. Saïd business school has an acceptance rate of 20 %, indicating a highly selective admission process. But that is quite expected from a business school of. Poets & Quants has an international ranking and does a pretty good job ranking them in terms of what is widely considered to be the pecking. Business school rankings, including MBA, MSC, and European MBA rankings from the Financial Times. 1 in 2 applicants to this programme received an offer. Data shown above is for entry in academic year /24 (sources). Today, the acceptance rate of the business school is merely 20% which makes it really tough for the candidates to get accepted. The average gpa required is The tuition for the Oxford MBA program is £78, per year. What is the average GMAT score for admission to the Oxford MBA program? Oxford Saïd MBA Class Profile ; Acceptance Rate, Does not disclose ; GMAT Median, ; Average Age, Does not disclose ; Avg. Years Work Experience, 6 ; Diversity. Average GMAT, ; Average age of the students, 28 years ; Average work experience, 5 years ; Tuition fees for international students, $78, ; Average salary of. Overall Rank: In , Oxford Saïd placed 26th, a slight decline compared to 's ranking. This still positions the program among top business. The University of Oxford Said Business School offers an exemplary MBA programme which has established itself as one of the best in the world. University of Oxford MBA course fees, scholarships, eligibility, application, ranking and more. Know How to get admission into University of Oxford MBA. The school was ranked 26th in the Financial Times Global MBA rankings. Saïd Business School Class of Key Statistics Entering Full-Time MBA Students. Oxford University ranks 13 in Global MBA Schools according to Financial Times Being ranked in top 15 B-School, Oxford holds a very good.

Growth Ereit

About Fundrise Growth eREIT VII, LLC. Fundrise Growth eREIT , LLC is a recently organized Delaware limited liability company formed to originate. In less than 12 months. The firm has raised $90 million across its two REITs, Income eREIT and Growth eREIT. And that fundraising success is. Explore the Growth & Income REIT offering. Gain exposure to multiple commercial real estate properties in one investment.. Learn more about this investment. The performance of residential REITs often reflects broader economic conditions, such as employment rates and population growth, which influence demand for. REITs offer a number of attractive attributes such as growth, income, and diversification. REIT index rather than investing in individual REITs. You. Growth VII eREIT Investment”). Fundrise Real Estate Interval Fund, LLC acquired ownership of the remaining equity interest in the new investment round in. Fundrise Growth eREIT , LLC is a Delaware limited liability company formed on February 1, to originate, invest in, and manage a diversified portfolio. The reason that I want to put RECF on everyone's radar, along with Fundrise's new Income and Growth eREIT, is because I believe that technology is fundamentally. In , Fundrise Equity REIT, LLC (the “Growth eREIT™”) executed on its strategy of focusing on the acquisition of Class B multifamily properties, by. About Fundrise Growth eREIT VII, LLC. Fundrise Growth eREIT , LLC is a recently organized Delaware limited liability company formed to originate. In less than 12 months. The firm has raised $90 million across its two REITs, Income eREIT and Growth eREIT. And that fundraising success is. Explore the Growth & Income REIT offering. Gain exposure to multiple commercial real estate properties in one investment.. Learn more about this investment. The performance of residential REITs often reflects broader economic conditions, such as employment rates and population growth, which influence demand for. REITs offer a number of attractive attributes such as growth, income, and diversification. REIT index rather than investing in individual REITs. You. Growth VII eREIT Investment”). Fundrise Real Estate Interval Fund, LLC acquired ownership of the remaining equity interest in the new investment round in. Fundrise Growth eREIT , LLC is a Delaware limited liability company formed on February 1, to originate, invest in, and manage a diversified portfolio. The reason that I want to put RECF on everyone's radar, along with Fundrise's new Income and Growth eREIT, is because I believe that technology is fundamentally. In , Fundrise Equity REIT, LLC (the “Growth eREIT™”) executed on its strategy of focusing on the acquisition of Class B multifamily properties, by.

View Fundrise Growth eREIT VI, LLC contracts and agreements from SEC filings. Including company executives, business partners, clauses and more. Their eREITs are specialized funds they invest in various types of real estate investments for different purposes e.g. growth, income, western part of the U.S. In , Fundrise sold out their first two eREITs, the Growth eREIT and Income eREIT. The platform ended up raising $ million in total under Regulation. Growth. Fundrise Growth eREIT II, LLC. Growth. Fundrise Growth eREIT III, LLC. Growth. Fundrise Growth eREIT VII, LLC. Growth. Fundrise Development eREIT, LLC. Fundrise Growth eREIT VII, LLC is a Delaware limited liability company formed to originate, invest in and manage a diversified portfolio of commercial real. Fundrise Development eREIT, LLC · Fundrise Income eREIT , LLC · ExchangeRight Income Fund · Fundrise Growth eREIT V, LLC · Fundrise Income eREIT V, LLC. Fundrise Growth Ereit Vii, LLC SEC Form 1-U Filed June 3, Current Report Pursuant to Regulatio Last Updated June 4, at AM EDT. Back to. Income eREIT: Debt and debt like securities. Return% dividend (+/- any appreciation). Growth eREIT: Commercial real estate assets they feel have the. The Growth eREIT focuses on equity. Unlike the Income eREIT, this fund owns properties with an eye towards appreciation. Its primary focus is on multi-units. Your portfolio options are as follows 1- Starter Portfolio. Minimum investment: $ Investment breakdown: Income eREIT (50%), Growth eREIT (50%). Find company research, competitor information, contact details & financial data for Fundrise Growth eREIT V, LLC of Washington, DC. About Fundrise Growth eREIT VII, LLC. Fundrise Growth eREIT , LLC is a recently organized Delaware limited liability company formed to originate. In , Fundrise Equity REIT, LLC (the “Growth eREIT™”) executed on its growing ranks of renters in markets where the Growth eREITTM has invested. Growth. We're focused on growth that delivers value. $67, Investment In Real Estate, Gross. Fundrise Growth eREIT III, LLC; Fundrise Income eREIT III, LLC; Fundrise Income. eREIT , LLC; and Fundrise Growth eREIT , LLC; all Delaware limited. SEC filings and transcripts for Fundrise Growth eREIT III, LLC, including financials, news, proxies, indentures, prospectuses, and credit agreements. How have REITs performed in the past? REITs' track record of reliable and growing dividends, combined with long-term capital appreciation through stock price. We have recently acquired a built-for-rent single family community in Denton, TX. This asset now powers our Growth eREIT VII and Flagship Fund. Learn. View the SEC offering information from Fundrise Growth eREIT , LLC, a Reg A filing. Early growth. edit. After the initial project, Fundrise was The company subsequently opened a second eREIT, the Fundrise Equity REIT, in February

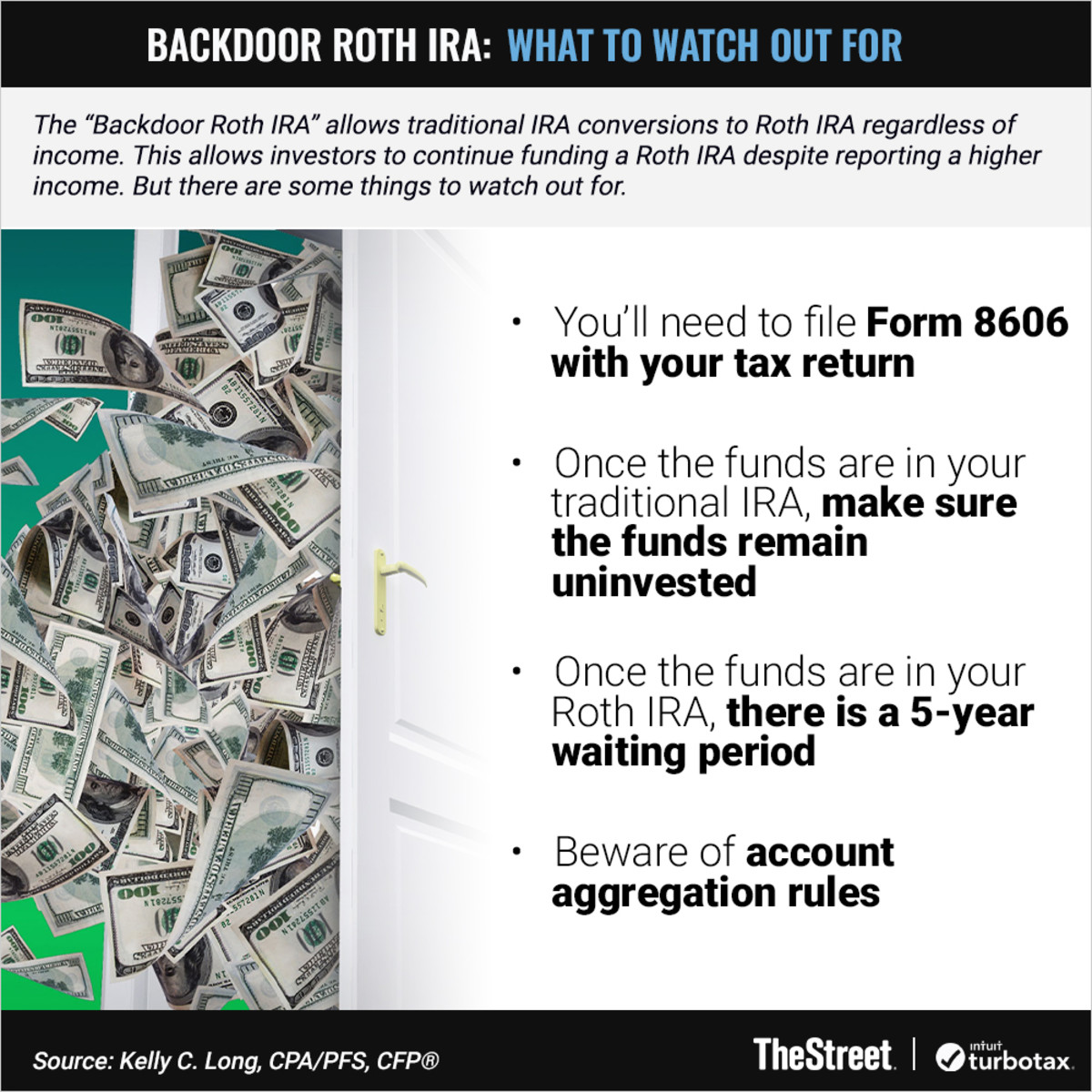

What Is Backdoor Ira

Are you a high-income earner? Learn how a Backdoor Roth IRA enables you to realize the tax benefits of a Roth IRA, even if your income exceeds the IRS. The purpose of the “Backdoor IRA” is so that a high income taxpayer (ordinarily high income taxpayers are excluded from a direct Roth IRA contribution) can. By this method, you open a traditional IRA, make your desired contribution, and then, at a later date, convert the funds to a Roth IRA. How does a backdoor Roth IRA work? It works by rolling over pretax retirement funds from a traditional IRA or (k) into a Roth IRA, even if you wouldn't. The mega backdoor Roth (MBD Roth) is a way for those with an employer-sponsored retirement plan (eg, a (k) or (b) plan) to potentially save more tax-free. A Roth conversion is a way to bypass the income limits on Roth contributions by high wage earners. There is no limit to how much you can convert to a Roth IRA. The backdoor Roth IRA is a strategy wealthy investors use to skirt around the usual income limits that apply to Roth IRA contributions. Learn how high-income earners can utilize the Backdoor Roth IRA strategy to fund a Roth IRA, even if they exceed income limits. Discover how Directed IRA. A backdoor Roth IRA allows you to get around income limits by converting a traditional IRA into a Roth IRA. You'll get a Form R the year you make the. Are you a high-income earner? Learn how a Backdoor Roth IRA enables you to realize the tax benefits of a Roth IRA, even if your income exceeds the IRS. The purpose of the “Backdoor IRA” is so that a high income taxpayer (ordinarily high income taxpayers are excluded from a direct Roth IRA contribution) can. By this method, you open a traditional IRA, make your desired contribution, and then, at a later date, convert the funds to a Roth IRA. How does a backdoor Roth IRA work? It works by rolling over pretax retirement funds from a traditional IRA or (k) into a Roth IRA, even if you wouldn't. The mega backdoor Roth (MBD Roth) is a way for those with an employer-sponsored retirement plan (eg, a (k) or (b) plan) to potentially save more tax-free. A Roth conversion is a way to bypass the income limits on Roth contributions by high wage earners. There is no limit to how much you can convert to a Roth IRA. The backdoor Roth IRA is a strategy wealthy investors use to skirt around the usual income limits that apply to Roth IRA contributions. Learn how high-income earners can utilize the Backdoor Roth IRA strategy to fund a Roth IRA, even if they exceed income limits. Discover how Directed IRA. A backdoor Roth IRA allows you to get around income limits by converting a traditional IRA into a Roth IRA. You'll get a Form R the year you make the.

A backdoor IRA is a planning strategy that enables high-income earners to contribute to a Roth IRA, even if they exceed the income limits set by the IRS. How does a backdoor Roth IRA work? It works by rolling over pretax retirement funds from a traditional IRA or (k) into a Roth IRA, even if you wouldn't. Known as a backdoor Roth IRA contribution, this strategy can be highly effective for creating tax-free income in retirement, but it's also quite complex. Backdoor Roth IRA conversions are performed by making non-deductible after-tax contributions to a Traditional IRA account and then rolling those into a Roth IRA. The most common backdoor is making a non-deductible contribution to a traditional IRA, and then immediately rolling into a Roth IRA. The reason? The Backdoor Roth IRA strategy allows you to make an indirect Roth IRA contribution if your income is too high to qualify for a direct contribution. A backdoor Roth IRA is a conversion that allows high earners to open a Roth IRA despite IRS-imposed income limits. A "backdoor Roth IRA" is a potential way for those who don't qualify for Roth IRA contributions to still be able to convert to a Roth and enjoy the tax-free. A backdoor Roth IRA is a Roth IRA that is created when those who cannot open Roth IRAs due to income limits convert their traditional IRAs into a Roth IRA. With. The backdoor Roth is a legal way high-income earners such as physicians can take advantage of a Roth IRA. A mega backdoor Roth refers to a strategy that can potentially allow some people who would be ineligible to contribute to a Roth account, based on their income. The Backdoor Roth IRA is one of the most widely useful exploitations of current tax law for high earners to receive additional tax deferral. It's a Roth IRA that is funded via a “backdoor” strategy. It allows high-income individuals and households to fund a Roth despite exceeding the IRS income. A backdoor Roth IRA is a two-step process. First, you open a traditional IRA using after-tax dollars instead of the pre-tax money you usually fund these. A backdoor Roth IRA doesn't necessarily benefit everyone, especially those who require access to the converted funds during their five-year window or can meet. The Backdoor Roth IRA is one of the most widely useful exploitations of current tax law for high earners to receive additional tax deferral. This post will give you a brief overview of the backdoor Roth, precise step-by-step instructions on how to do this yourself at Vanguard. A backdoor Roth IRA can be an effective strategy to reduce your tax burden during retirement while taking advantage of future growth opportunities. What Is a Backdoor Roth IRA? · Make less than $1, as single, head of household, or married and filing separately · Make less than $, as married and. If your income disqualifies you from contributing to a Roth IRA, think again. Learn more about the backdoor Roth IRA strategy.

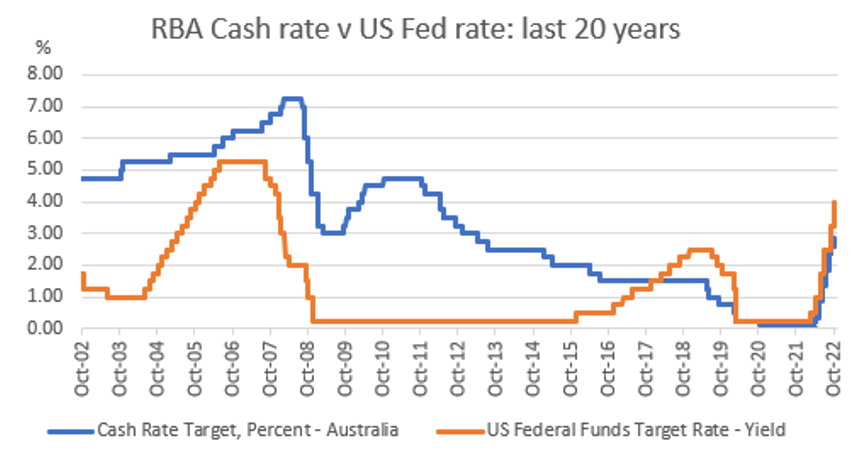

Australian Current Interest Rates

This page shows the current and historic values of the Official Cash Rate (Cash Rate Target) as set by the Australian Central Bank (Reserve Bank of Australia. So, what can you expect when it comes to interest rates in ? As of May , Australia's current interest rate is %. This is a far cry from the % we. The cash rate is the interest rate on unsecured overnight loans between banks. It is the (near) risk-free benchmark rate (RFR) for the Australian dollar. Rates exceeded 10% for the first time in and pretty much remained above 10% until In just 4 years, interest rates dropped from the high of 17% . Australia: Markets ; Monetary Policy Rate, 11 Sep , ; Money Market Rate, 10 Sep , ; Average Long-term Government Bond, 04 Sep , ; Stock. Big four banks' cash rate forecasts · CBA: Peak of % in November , then dropping to % by December · Westpac: Peak of % in November , then. Mortgage Rate in Australia remained unchanged at percent in March. This page includes a chart with historical data for Australia Mortgage Rate. Central Banks interest rates Current and historical interest rates of the major central banks worldwide ; Australian Central Bank. Australia. % ; Brazilian. Get the RBA Interest Rate Decision results in real time as they're announced and see the immediate global market impact. This page shows the current and historic values of the Official Cash Rate (Cash Rate Target) as set by the Australian Central Bank (Reserve Bank of Australia. So, what can you expect when it comes to interest rates in ? As of May , Australia's current interest rate is %. This is a far cry from the % we. The cash rate is the interest rate on unsecured overnight loans between banks. It is the (near) risk-free benchmark rate (RFR) for the Australian dollar. Rates exceeded 10% for the first time in and pretty much remained above 10% until In just 4 years, interest rates dropped from the high of 17% . Australia: Markets ; Monetary Policy Rate, 11 Sep , ; Money Market Rate, 10 Sep , ; Average Long-term Government Bond, 04 Sep , ; Stock. Big four banks' cash rate forecasts · CBA: Peak of % in November , then dropping to % by December · Westpac: Peak of % in November , then. Mortgage Rate in Australia remained unchanged at percent in March. This page includes a chart with historical data for Australia Mortgage Rate. Central Banks interest rates Current and historical interest rates of the major central banks worldwide ; Australian Central Bank. Australia. % ; Brazilian. Get the RBA Interest Rate Decision results in real time as they're announced and see the immediate global market impact.

The average variable rate† in the Mozo database is % p.a., while the lowest home loan rate is Homeloans's Owner Variable Home Loan, at % p.a. (%. Compare home loans from 39 Australian lenders, with lowest home loan rates starting from: * Note: the home loan with the lowest current interest rate is not. Compare home loans from 39 Australian lenders, with lowest home loan rates starting from: * Note: the home loan with the lowest current interest rate is not. Bank of China@Australia,BOC Australia,Information,Interest Rates. Current Position: Home > BOC Australia > Information > Interest Rates. Current RBA cash rate: %. The cash rate is Australia's official interest rate which is currently held at a target of % by the Reserve Bank of Australia. (Includes discount of % p.a.). % p.a., % p.a.. LVR above 70% up to 80% (No change to standard rate). %. Latest investment principal and interest home loans ; 1 Year, 2 Year ; Average, %, % ; Minimum, %, % ; Maximum, %, %. Interest rates have increased regularly since May , going up 13 times in 15 months. Before that, the cash rate was less than per cent since July The discounted interest rate is %p.a. for a period of 3 years. Discount applied to the advertised Basic Variable (Owner Occupier) Rate, current rates are. Rate of interest ; %. 1 July to 31 December ; %. 1 January to 30 June ; %. 1 July to 31 December ; %. 1 January Get updated data about Australian bonds. Find information on government bonds yields and interest rates in Australia. Competitive fixed and standard variable rates in Australia for your home or investment property. Compare home loans and see mortgage interest rates. % p.a. % p.a.. ANZ Standard Variable home loan. LVR more than 80%. Interest rate. % ; This is the 'Indicator Lending Rates - Bank variable housing loans interest rate' published by the Reserve Bank of Australia on 4 June The current inflation – not only in Australia but also in the US and Europe – is still way too high, so I expect the RBA to increase the cash rate a few more. Australia Bank Ltd Code of Conduct · Banking Code of Practice · Code of See our current fixed and variable interest rates for both owners and investors. Reserve Bank of Australia Rates ; ; The discounted interest rate is %p.a. for a period of 3 years. Discount applied to the advertised Basic Variable (Owner Occupier) Rate, current rates are. Interest rates ; Up to $83,, %, %, 24 months ; $83, - $,, %, %, 12 months. From rate cuts to breaking news and announcements. Find the latest news and updates on interest rates in Australia.

How To Get More Credit Limit On Credit Card

The easiest route to a high limit is with American Express. They are known for giving out 3x credit limit increases ($5k -> 15k) when you. If you have a new credit card and aren't sure what your credit limit is, don't worry, it's easy to find. Your credit limit will be included on your credit card. There are four ways to increase your credit limit on a credit card. They include requesting a higher limit from your credit card's issuer. A Visions Federal Credit Union member can request a credit card limit increase by submitting a loan application online. Select the type of credit card you have. There are four ways to increase your credit limit on a credit card. They include requesting a higher limit from your credit card's issuer. To get approved for a high limit credit card, you will need good to excellent credit and proof that you can afford a high spending limit. More specifically. Next, contact your lender and ask for a credit limit increase. Applying online is a good option if you think you're a good candidate with a high chance of. Sometimes your card issuer will offer to increase your credit limit after you've consistently demonstrated that you use the card responsibly. This includes. To request an Apple Card credit limit increase, you can chat with an Apple Card Specialist at Goldman Sachs. The easiest route to a high limit is with American Express. They are known for giving out 3x credit limit increases ($5k -> 15k) when you. If you have a new credit card and aren't sure what your credit limit is, don't worry, it's easy to find. Your credit limit will be included on your credit card. There are four ways to increase your credit limit on a credit card. They include requesting a higher limit from your credit card's issuer. A Visions Federal Credit Union member can request a credit card limit increase by submitting a loan application online. Select the type of credit card you have. There are four ways to increase your credit limit on a credit card. They include requesting a higher limit from your credit card's issuer. To get approved for a high limit credit card, you will need good to excellent credit and proof that you can afford a high spending limit. More specifically. Next, contact your lender and ask for a credit limit increase. Applying online is a good option if you think you're a good candidate with a high chance of. Sometimes your card issuer will offer to increase your credit limit after you've consistently demonstrated that you use the card responsibly. This includes. To request an Apple Card credit limit increase, you can chat with an Apple Card Specialist at Goldman Sachs.

Here's six smart tips to increase your credit card limit that suit your needs. 1. Boost Your Credit Score 2. Repay dues on time 3. Check Credit Utilisation. If you have an American Express Card, you will have to consent to the credit card limit increase before it is applied to your account. Request for a credit. Being smart about how you use your credit card — and paying your bill on time and in full each billing cycle — can help increase your credit limit. There are two ways to get a credit limit increase. One is asking for a credit limit increase on an existing credit card – usually one you've had for at least a. Log in to your credit card company's website, pull up your account's main menu and look for the option to ask for a higher limit. Then, answer the questions. Do you need access to a higher credit limit? Sign in your account to view your eligibility and request a credit limit increase. Receiving a credit limit increase lowers your credit utilization ratio and will help your overall credit score over the long term. To potentially improve your odds of a credit limit increase, keep your account in good standing, pay your bills on time, and maintain a lower utilization rate. A credit card or other type of loan known as open-end credit, adjusts the available credit within your credit limit when you make payment on your account. To get approved for high-limit credit cards, you'll most likely need to have good or excellent credit and a steady income to support a higher credit limit. Increasing your credit limit can lower your credit utilization ratio, potentially boosting your credit score. · A credit score is an important metric that. If you have a trusted family member or friend with a credit card that has a high credit limit, you may want to consider asking them to add you as an authorized. It's possible to increase credit limit. This will work if you have been using your Credit Cards successfully, paying all your dues in time and making the best. A higher card limit could increase your credit rating – the number that lenders use to determine your creditworthiness. Credit limit increase requests can be submitted using digital banking. If your account has a joint owner, we'll need their details as well. Before doing so, you. Otherwise, if you'd like an increase, you can contact your credit card company to request one. There are several actions you can take that will help you. Provident is here to help. Answers to frequently asked questions about credit line increases, how they work, and much more. If you have more than one credit card, you will need to select the card you want the request to be for. Afterwards, provide the required employment, income, and. Another option is to call customer service and ask for an increase. This option gives your request a personal touch and allows you to explain your reasoning why. When you add authorized users, such as family members, to your account, they may make purchases on the account. For your security, the account holder is the.

How To Invest On Apple

Yes, you can purchase fractional shares of Apple Inc (AAPL) via the Vested app. You can start investing in Apple Inc (AAPL) with a minimum investment of $1. View Apple Inc. AAPL stock quote prices, financial information, real Buy Apple Stock Before September 9? Here's What Ivan Feinseth Expects by. Here's a step-by-step guide on buying shares of Apple and some factors to consider before investing in the technology stock. Access real-time $Apple stock insights on eToro. ➤ View prices, charts, and analyst price target ✓ Invest in AAPL Now. The easiest way to get hold of some Apple shares is to sign up for a stock trading app and place a market order or basic order. This type of order tells the. Apple's innovation and profitability have made it an exceptional long-term investment. · Services segment growth has helped offset stagnating iPhone sales. · The. 1. Sign up for a brokerage account on Public. It's easy to get started. · 2. Add funds to your Public account · 3. Choose how much you'd like to invest in Apple. Yes, Indian Investors can invest in the Apple, Inc. (AAPL) Share by opening an international trading account with Angel One. How can I purchase Apple, Inc. One can easily invest in Apple Inc shares from India by: Direct Investment - Opening an international trading account with Groww which includes KYC verification. Yes, you can purchase fractional shares of Apple Inc (AAPL) via the Vested app. You can start investing in Apple Inc (AAPL) with a minimum investment of $1. View Apple Inc. AAPL stock quote prices, financial information, real Buy Apple Stock Before September 9? Here's What Ivan Feinseth Expects by. Here's a step-by-step guide on buying shares of Apple and some factors to consider before investing in the technology stock. Access real-time $Apple stock insights on eToro. ➤ View prices, charts, and analyst price target ✓ Invest in AAPL Now. The easiest way to get hold of some Apple shares is to sign up for a stock trading app and place a market order or basic order. This type of order tells the. Apple's innovation and profitability have made it an exceptional long-term investment. · Services segment growth has helped offset stagnating iPhone sales. · The. 1. Sign up for a brokerage account on Public. It's easy to get started. · 2. Add funds to your Public account · 3. Choose how much you'd like to invest in Apple. Yes, Indian Investors can invest in the Apple, Inc. (AAPL) Share by opening an international trading account with Angel One. How can I purchase Apple, Inc. One can easily invest in Apple Inc shares from India by: Direct Investment - Opening an international trading account with Groww which includes KYC verification.

Why Robinhood? Robinhood gives you the tools you need to put your money in motion. You can buy or sell Apple and other ETFs, options, and stocks. 1. Open A Brokerage Account. To start investing, you will need a brokerage account. There are many brokerage companies on the market. Latest On Apple Inc. ALL CNBC INVESTING CLUB PRO. Nvidia announces $50 Content From Our Affiliates. Should You Buy Apple Stock Before September 9. Select 'APPL' (Stock's Trading Symbol) at the Broker's Trading application, and then open an order to buy it at, either the market price, or the limit price. 1 Enter the amount you'd like to invest in Apple stock, then proceed to checkout. · 2 Choose a Stash plan and set up your investment account in just a few. Here's a step-by-step guide on buying shares of Apple and some factors to consider before investing in the technology stock. Requires iOS or later. Apple Vision: Requires visionOS or later. Languages. English. Age Rating. Of course it is. Apple is a publicly traded company. You can buy Apple stock with a limit order so that when the price drops below your. Apple and Nvidia in talks to invest in OpenAI: report. Aug. 30, at a.m. ET by Louis Goss. Read full story. Opinion Nvidia is starting to look a lot. We outline the most cost-effective, secure and user-friendly platforms for anyone wanting to buy Apple shares. View the AAPL premarket stock price ahead of the market session or assess the after hours quote. Monitor the latest movements within the Apple Inc real time. Yes, Indian Investors can invest in the Apple, Inc. (AAPL) Share by opening an international trading account with Angel One. How can I purchase Apple, Inc. Step by step on how to buy Apple stock · 1. Open a brokerage account: Brokerage firms allow investors to buy and sell stocks, funds and bonds. · 2. Open an order. Apple trading hours are the time when investors can buy and sell shares of Apple (#S-AAPL). Apple's stock is traded on multiple exchanges around the world. With iCloud you can track your Stocks whether you're on your Mac, your iPad, your Apple Watch, or on your iPhone. Invest in Apple, NASDAQ: AAPL Stock - View real-time AAPL price charts. Online commission-free investing in Apple: buy or sell Apple Stock commission-free. According to our experts, Apple stock is not a great investment right now and investors should not risk their hard-earned cash on Apple shares. If you're looking to invest in Apple, figure out if you're in it for the long haul or are looking for a quick return. If it's a bet on the company's future. How to buy Apple stock & shares to invest in AAPL · Apple stock is traded on the Nasdaq stock exchange under the AAPL ticker. · AAPL currently makes up about 6%. This article provides a definitive guide to investing in Apple, the specific options available to investors, and the processes involved in each option.

Sb Stock Forecast

Earnings for Safe Bulkers are expected to grow by % in the coming year, from $ to $ per share. Price to Earnings Ratio vs. the Market. The P/E ratio. How much is Safe Bulkers's stock price per share? (NYSE: SB) Safe Bulkers stock price per share is $ today (as of Jul 17, ). · What is Safe Bulkers's. View Safe Bulkers, Inc. SB stock quote prices, financial information, real-time forecasts, and company news from CNN. Comprehensive Stock Forecast for SB Understanding the future trajectory of a stock is crucial for investors, and SB is no exception. With numerous analysts. The Change in Consensus chart shows the current, 1 week ago, and 1 month ago consensus earnings per share (EPS*) forecasts. For the fiscal quarter endingSep. Find the latest Safe Bulkers Inc (SB) stock forecast, month price target, predictions and analyst recommendations. The forecasts range from a low of $ to a high of $ The average price target represents an increase of % from the last closing price of $ According to analysts, SB price target is USD with a max estimate of USD and a min estimate of USD. Check if this forecast comes true in a year. (NYSE: SB) Safe Bulkers's current Earnings Per Share (EPS) is $ On average, analysts forecast that SB's EPS will be $ for , with the lowest EPS. Earnings for Safe Bulkers are expected to grow by % in the coming year, from $ to $ per share. Price to Earnings Ratio vs. the Market. The P/E ratio. How much is Safe Bulkers's stock price per share? (NYSE: SB) Safe Bulkers stock price per share is $ today (as of Jul 17, ). · What is Safe Bulkers's. View Safe Bulkers, Inc. SB stock quote prices, financial information, real-time forecasts, and company news from CNN. Comprehensive Stock Forecast for SB Understanding the future trajectory of a stock is crucial for investors, and SB is no exception. With numerous analysts. The Change in Consensus chart shows the current, 1 week ago, and 1 month ago consensus earnings per share (EPS*) forecasts. For the fiscal quarter endingSep. Find the latest Safe Bulkers Inc (SB) stock forecast, month price target, predictions and analyst recommendations. The forecasts range from a low of $ to a high of $ The average price target represents an increase of % from the last closing price of $ According to analysts, SB price target is USD with a max estimate of USD and a min estimate of USD. Check if this forecast comes true in a year. (NYSE: SB) Safe Bulkers's current Earnings Per Share (EPS) is $ On average, analysts forecast that SB's EPS will be $ for , with the lowest EPS.

Safe Bulkers (SB) stock price prediction is USD. The Safe Bulkers stock forecast is USD for August 25, Monday;. There is currently no analyst price target forecast available for Safe Bulkers. Analyst Consensus: n/a. Safe Bulkers (SB-PD) stock price prediction is USD. The Safe Bulkers stock forecast is USD for July 10, Thursday;. 10 Top Safe Bulkers SB Share price target (tomorrow) | 10 top stock Price (target) Safe Bulkers SB NYSE · Safe Bulkers SB share price targets for August month. Safe Bulkers Inc stock price down % on Thursday (Updated on Aug 22, ) · % during the next 3 months and, with a 90% probability hold a price. SB WHLRP · Stocks Under $10 · Best Stocks Under 10 Based on Algorithmic Trading: Returns up to % in 1 Month. July 7, Package Name: Stocks Under $ Discover Safe Bulkers' earnings and revenue growth rates, forecasts, and the latest analyst predictions while comparing them to its industry peers. View live Safe Bulkers, Inc chart to track its stock's price action. Find market predictions, SB financials and market news. Bid Price and Ask Price. The bid & ask refers to the price that an investor is willing to buy or sell a stock. The bid is the highest amount that a buyer is. Safe Bulkers Stock Forecast, SB-PC stock price prediction. Price target in 14 days: USD. The best long-term & short-term Safe Bulkers share price. The Safe Bulkers stock forecast for tomorrow is $ , which would represent a % loss compared to the current price. In the next week, the price of SB is. What was Safe Bulkers's price range in the past 12 months? Safe Bulkers lowest stock price was $ and its highest was $ in the past 12 months. Based on the share price being below its 5, 20 & 50 day exponential moving averages, the current trend is considered strongly bearish and SB is experiencing. Based on our forecasts, a long-term increase is expected, the "SB" stock price prognosis for is USD. With a 5-year investment, the revenue is. Safe Bulkers NYSE:SB Stock Report ; Last Price. US$ ; Market Cap. US$m ; 7D. % ; 1Y. % ; Updated. 26 Aug, Get Safe Bulkers Inc (SB:NYSE) real-time stock quotes, news, price and financial information from CNBC. Safe Bulkers Inc (NYSE: SB) has agreed to sell MV Pedhoulas Trader, a Japanese-built, Kamsarmax class, dry-bulk vessel, for a net sale price of $ Safe Bulkers, Inc.: Forcasts, revenue, earnings, analysts expectations, ratios for Safe Bulkers, Inc. Stock | SB | MHYL SB's current price target is $ Learn why top analysts are making this stock forecast for Safe Bulkers at MarketBeat. Safe Bulkers (SB-PD) stock price prediction is USD. The Safe Bulkers stock forecast is USD for July 10, Thursday;.

What Is A Good Beta Score For A Stock

Conversely, if you are seeking potentially higher returns in exchange for higher risk, higher beta stocks might generally be a good match. Alpha vs. beta. ". Morningstar calculates beta by comparing a fund's excess return over T-bills to the market's excess return over T-bills, so a beta of shows that the fund. Low Beta Stocks If a stock has a beta value less than , this is considered to be a good beta value for a stock, because it indicates that stock has a price. The S&P Index is the base for calculating beta with a value of Securities with betas below 1 have historically been less volatile than the market. The Beta coefficient is a measure of sensitivity or correlation of a security or an investment portfolio to movements in the overall market. Roughly speaking, a security with a beta of , will have move, on average, times the market return. [More precisely, that stock's excess return (over and. The beta (β) of an investment security (ie, a stock) is a measurement of its volatility of returns relative to the entire market. The measurement of beta indicates a company's susceptibility to change in systematic factors such as the rate of inflation, Federal Reserve monetary policy, and. However, as a general rule, a good stock market beta for an investment portfolio is around , while a good alpha is around Keep in mind. Conversely, if you are seeking potentially higher returns in exchange for higher risk, higher beta stocks might generally be a good match. Alpha vs. beta. ". Morningstar calculates beta by comparing a fund's excess return over T-bills to the market's excess return over T-bills, so a beta of shows that the fund. Low Beta Stocks If a stock has a beta value less than , this is considered to be a good beta value for a stock, because it indicates that stock has a price. The S&P Index is the base for calculating beta with a value of Securities with betas below 1 have historically been less volatile than the market. The Beta coefficient is a measure of sensitivity or correlation of a security or an investment portfolio to movements in the overall market. Roughly speaking, a security with a beta of , will have move, on average, times the market return. [More precisely, that stock's excess return (over and. The beta (β) of an investment security (ie, a stock) is a measurement of its volatility of returns relative to the entire market. The measurement of beta indicates a company's susceptibility to change in systematic factors such as the rate of inflation, Federal Reserve monetary policy, and. However, as a general rule, a good stock market beta for an investment portfolio is around , while a good alpha is around Keep in mind.

For active traders, financial software programs will also provide the beta value. When using a provided beta, investors should pay attention to two variables. A high beta stock — one that tends to rise and fall along with the market often — has a value of greater than 1. So if a stock has a beta of and is. The beta value of stocks is an important factor when deciding how to invest, as it tells us the risk/reward potential of a stock. In other words, the amount of. A high Beta (greater than 1) can suggest a stock with higher risk, but also the potential for higher returns. Such stocks are usually growth stocks or smaller. Individuals having a high aptitude for risk can invest in stocks having a beta value of higher than 1, to ensure substantial returns on the portfolio. Value investors focus on whether the current stock price makes sense investing in great companies at a good price, not simply buying cheap stocks. If you know the S&P beta is but a stock within the major market index has a beta of , it suggests that the stock is 50% more volatile than the market. In finance, the beta is a statistic that measures the expected increase or decrease of an individual stock price in proportion to movements of the stock. The beta value can be less than zero, meaning either that the stock is losing money while the market as a whole is gaining (more likely) or that the stock is. The first beta is a long-term estimate. The second and more novel beta estimate is a time-varying beta which reflects recent market conditions and stock price. A beta score for stocks helps assess how volatile a stock is relative to a major stock index. In this way, beta is a quick measure that traders can use to. After all, if you invest in it, you can lose 50% very quickly, for no good reason. Value stocks tend to be low beta. They move slowly compared. stock's Beta score developed. ios android. TipRanks is a recommended by the model and the markets were sufficiently liquid to permit all trading. A company stock with beta less than one is called a defensive stock. Beta is useful for risk management. Can you see how knowing the value of beta could be. Beta measures a stock's volatility and is often used by risk-tolerant traders. US stocks below have the highest beta: they're sorted by yearly beta and together. Thus, a Beta value of more than 1 denotes that the portfolio/fund returns will move in excess of the market movement and vice versa. So, while the market is. The S&P ® High Beta Index measures the performance of constituents in the S&P that are most sensitive to changes in market returns. A stock with a high beta value indicates that it is more volatile than the market. These stocks tend to experience larger price fluctuations in response to. Definition: Beta is a numeric value that measures the fluctuations of a stock to changes in the overall stock market. Description: Beta measures the. Beta is a calculation that measures relative volatility of a stock in relation to a benchmark, typically the S&P Stocks with high beta are prone to.

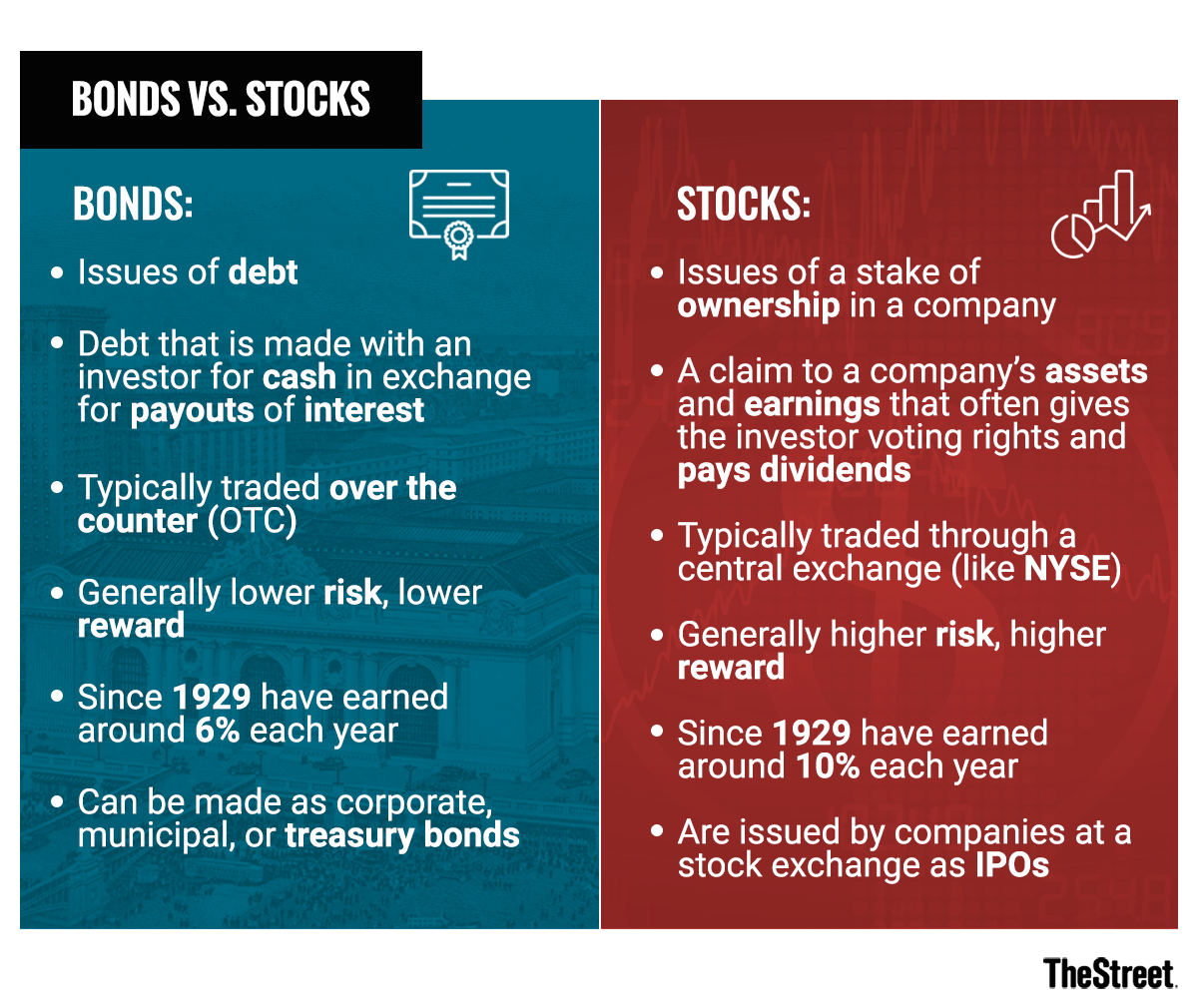

Bonds Vs Stocks 2021

When comparing relative risk and returns, though stocks historically have generated larger returns over the long run, in shorter time periods stock prices have. The correlation between stock and bond returns has been reliably and persistently negative for the last two decades across Developed Markets (DM) – matching. Bonds participate in a different market than the stock market, which makes them subject to a different volatility. Buying bonds changes part of. Historically low interest rates hindered bonds from fulfilling their primary role of providing adequate income and offsetting equity losses. Higher rates could. government bonds, and Treasury bills should all have a place in a properly allocated long-term investment strategy. Stocks, Bonds, Bills, and Inflation –. We need to first look at the differences between a bond and a stock to answer the question of should I invest in stocks or bonds? Stocks will give you ownership. The single biggest difference is that Stocks represent ownership (or 'Equity') in a Business whereas a Bond is simply Debt. How are Bonds. Here, you can see the inverse relationship between stocks and bonds, where the value of the S&P and a US Treasury bond tend to move in opposite directions. The relationship between stock and bond returns is a fundamental determinant of risk in traditional portfolios. For the first two decades of the 21st century. When comparing relative risk and returns, though stocks historically have generated larger returns over the long run, in shorter time periods stock prices have. The correlation between stock and bond returns has been reliably and persistently negative for the last two decades across Developed Markets (DM) – matching. Bonds participate in a different market than the stock market, which makes them subject to a different volatility. Buying bonds changes part of. Historically low interest rates hindered bonds from fulfilling their primary role of providing adequate income and offsetting equity losses. Higher rates could. government bonds, and Treasury bills should all have a place in a properly allocated long-term investment strategy. Stocks, Bonds, Bills, and Inflation –. We need to first look at the differences between a bond and a stock to answer the question of should I invest in stocks or bonds? Stocks will give you ownership. The single biggest difference is that Stocks represent ownership (or 'Equity') in a Business whereas a Bond is simply Debt. How are Bonds. Here, you can see the inverse relationship between stocks and bonds, where the value of the S&P and a US Treasury bond tend to move in opposite directions. The relationship between stock and bond returns is a fundamental determinant of risk in traditional portfolios. For the first two decades of the 21st century.

Historical Returns on Stocks, Bonds and Bills: Data Used: Multiple , %, %, %, %, %, %, $ ,, $ 2,

Since , large stocks have returned an average of 10 % per year; long-term government bonds have returned between 5% and 6%, according to investment. Historically low interest rates hindered bonds from fulfilling their primary role of providing adequate income and offsetting equity losses. Higher rates could. In the spring of , inflation in the United States began to rise over three percent and would grow to over six percent by September In response, the. From August to December , the average U.S. bond market total returns following the end of a rate hike cycle was roughly 8% after six months and 13%. Stocks are investments in which the investor takes an ownership interest in the corporation. Bonds allow investors to lend money to the corporation and receive. They can't compete with stocks in that area. Bonds are there to reduce volatility and to do asset liability matching. Reducing volatility helps. At the end of , short-term Treasury bonds offered yields barely above zero. When comparing stocks or bonds and iShares Funds, it should be remembered. For many investors, bonds are owned as a component of a diversified portfolio alongside other asset classes such as stocks. When comparing relative risk and. Unlike stock markets, corporate bond markets see decreased transaction costs and improved liquidity around earnings announcements, with bid-ask spreads. Bonds and bank loans form what is known as the credit market. The global credit market in aggregate is about three times the size of the global equity market. Bonds participate in a different market than the stock market, which makes them subject to a different volatility. Buying bonds changes part of. Stocks and bonds are falling in tandem. This has caused some investors to question if bonds have lost their diversification benefits. We don't think so. Key takeaways · Now's the time · Why bonds may be better than cash or stocks in the second half of · Back to normal at last? · Beyond investment-grade bonds. The relationship between stocks and bonds has not always been consistent. There have been periods when the two asset classes have moved in the same direction. designated NAIC 1 and NAIC 2 increasing to % of total bond exposure from 94% at year-end. Page 2. 2. Chart 1: Historical U.S. Insurance Industry Total. Historically low interest rates hindered bonds from fulfilling their primary role of providing adequate income and offsetting equity losses. Higher rates could. funds, with the remaining % split between U.S. Treasury securities; agency & GSE securities; municipal bonds; money market funds; and corporate bonds. Publicly traded bonds and stocks are the most common types of financial securities held by investors. A bond signifies an interest-bearing loan made by an. Buying individual bonds may not be right for every investor. You need a significant amount of time and money to research and manage individual bonds in. Notes: equity and bond returns are based on US large-cap equities and year US Treasuries. Data to 31 December 5-year rolling equity-bond correlation. -.