desenvolvertalentos.online Gainers & Losers

Gainers & Losers

How Much Interest Rate In Savings Account

:max_bytes(150000):strip_icc()/how-interest-rates-work-savings-accounts.asp-3644536378554b9ab3ecab2747aa066c.jpg)

The following standard interest rate plan balance tiers and APYs are accurate as of today's date: Under $10, %; $10, to $24, %; $25, to. Chase Savings℠ account earns interest, see current rates. Learn how interest rate on savings accounts is compounded & credited monthly. The best high-yield savings accounts offer % APY from BrioDirect High Yield Savings Account and % APY from Ivy Bank High-Yield Savings Account. The APY on a savings account is variable. This means that an account's APY can go up when the economy is doing well and the Federal Reserve raises interest. Money market accounts require higher balances, typically offer higher interest rates, and provide the flexibility of writing checks to access your funds. Thank you for choosing TD. The information in this document will help you identify the interest rates applicable to your Account and understand how we calculate. Today's savings rates. Way2Save ® Savings. Balance $0 or more. Standard Interest Rate %. Annual Percentage Yield (APY) %. Interest rates. Earns at a steady rate of%. Automatic transfers. Today's rates remain high, with the national average at around % and top banks offering rates of 5% APY or higher. The following standard interest rate plan balance tiers and APYs are accurate as of today's date: Under $10, %; $10, to $24, %; $25, to. Chase Savings℠ account earns interest, see current rates. Learn how interest rate on savings accounts is compounded & credited monthly. The best high-yield savings accounts offer % APY from BrioDirect High Yield Savings Account and % APY from Ivy Bank High-Yield Savings Account. The APY on a savings account is variable. This means that an account's APY can go up when the economy is doing well and the Federal Reserve raises interest. Money market accounts require higher balances, typically offer higher interest rates, and provide the flexibility of writing checks to access your funds. Thank you for choosing TD. The information in this document will help you identify the interest rates applicable to your Account and understand how we calculate. Today's savings rates. Way2Save ® Savings. Balance $0 or more. Standard Interest Rate %. Annual Percentage Yield (APY) %. Interest rates. Earns at a steady rate of%. Automatic transfers. Today's rates remain high, with the national average at around % and top banks offering rates of 5% APY or higher.

Maximize your savings with Tangerine. Competitive interest rates on various savings accounts. Secure, flexible, and rewarding. Check our latest rates today! Personal Account Acts like chequing, earns like savings—with % interest (Footnote). You will also see your effective interest rate on your Personal. However, most savings accounts calculate and pay interest monthly instead of annually. So, how do you find your monthly interest rate? It's easy. Simply divide. Earn more with % APY63 (that's 15x the bank industry average!71). And with fewer fees, rest easy knowing your money will stay your money. Move. Best savings account rates · UFB Direct — % APY, no minimum deposit to open · Bread Savings — % APY, $ minimum deposit to open · Bask Bank — % APY. Explore Citi's current rate offerings for savings accounts. Rates may vary between locations and which savings account you open. Member FDIC. Savings accounts earn compound interest on a daily, monthly, quarterly or annual basis. If interest is compounded daily, it's calculated and added to your. With the Bask Bank Interest Savings Account, you can earn % APY with no monthly account fees. It doesn't have a minimum balance or deposit requirement;. Depending on your account, your bank could use either simple or compound interest to figure out how much money you'll earn in interest. Featured savings accounts ; Balance $3, to $9,, % ; Balance $10, to $24,, % ; Balance $25, to $59,, % ; On portion of. The best high-yield savings account rate from a nationally available institution is % APY, available from Poppy Bank. An example of how the Booster works with hypothetical interest rates: If the Standard Rate is % then the Platinum rate would be the Standard Rate plus at. Compare Relationship Savings Interest Rates ; $ to $4, %. %. %. % ; $5, to $2,, %. %. %. %. It's easy to grow your savings with competitive rates and no transaction fees. Check out today's rates for our high interest savings account. Compare savings account rates ; Credit Karma Money Save, %, $0 ; Varo High-Yield Savings, %, $0 ; TAB Bank High-Yield Savings, %, $0 ; Newtek Bank. The most recent rates from the FDIC put the national savings APY average at %, while there are many high-yield savings accounts that offer a % APY or. The formula for calculating interest on a savings account is: Balance x Rate x Number of years = Simple interest. What's Compound Interest Compared With Simple. Personal Savings Account Fees and Disclosures ; Balance Tier, Interest Rate, Annual Percentage Yield (“APY”)* ; $ – $2,, Interest Rate %, APY %*. If your savings account earns only a % annual interest rate, which is common with large banks, your earnings after a year would be $1. Put that $10, in a. $5, (principal) x (rate) x 1 (time; one year) = $ You would earn $ in that one year, assuming your savings interest rate remains the same and.

Best Stablecoin Yield Farming

YieldFlow is in the Leading DeFi Yield Farming Platforms that stands out for its high APYs. This innovative service strives to turn unused cryptocurrencies into. Yield Yak provides auto-compounding yield farms, (DEX) aggregator, and liquid staking tools. Avalanche Logo. PoolTogether Logo PoolTogether. DeFi Yield. Best Stablecoin Yields Greater than 20%— Base Edition · Base is really hot right now · BaseSwap: Up to 22% APR · Swapbased: Up to 86% APR. This system enables better capital efficiency for both yield farmers and lenders. stablecoin and stablecoin assets in a leveraged position. Popular. These conditions are not favorable to stablecoin farmers, who are often risk-averse, or to new users who cannot obtain PTP cost-effectively. Echidna eliminates. Today's Yield Farming Coins Prices ; R · Rally. RLY. $ $ +%. +% ; H · Harvest Finance. FARM. $ $ +%. +%. The best yield farms (or at least the highest value ones) are on ETH (Aave, Curve, UNI, etc.), but BSC has enough large projects including CAKEs and Venus. Yield Yak offers a comprehensive suite of tools including auto-compounding yield farms, a decentralized exchange (DEX) aggregator, and liquid staking solutions. Yield farming projects allow users to lock their cryptocurrency tokens for a set period to earn rewards for their tokens. Yield farms use smart contracts to. YieldFlow is in the Leading DeFi Yield Farming Platforms that stands out for its high APYs. This innovative service strives to turn unused cryptocurrencies into. Yield Yak provides auto-compounding yield farms, (DEX) aggregator, and liquid staking tools. Avalanche Logo. PoolTogether Logo PoolTogether. DeFi Yield. Best Stablecoin Yields Greater than 20%— Base Edition · Base is really hot right now · BaseSwap: Up to 22% APR · Swapbased: Up to 86% APR. This system enables better capital efficiency for both yield farmers and lenders. stablecoin and stablecoin assets in a leveraged position. Popular. These conditions are not favorable to stablecoin farmers, who are often risk-averse, or to new users who cannot obtain PTP cost-effectively. Echidna eliminates. Today's Yield Farming Coins Prices ; R · Rally. RLY. $ $ +%. +% ; H · Harvest Finance. FARM. $ $ +%. +%. The best yield farms (or at least the highest value ones) are on ETH (Aave, Curve, UNI, etc.), but BSC has enough large projects including CAKEs and Venus. Yield Yak offers a comprehensive suite of tools including auto-compounding yield farms, a decentralized exchange (DEX) aggregator, and liquid staking solutions. Yield farming projects allow users to lock their cryptocurrency tokens for a set period to earn rewards for their tokens. Yield farms use smart contracts to.

Defi Pulse is a good place for you to track TVL. It provides an excellent overview of the current state of the yield farming market. Naturally, the greater the. Stablecoin yield farming is a variant of yield farming that involves utilizing stablecoins, which are cryptocurrencies pegged to a stable asset like the US. What is DeFi Yield Farming? · Liquidity Pool Liquidity pools refer to the pools of tokens or assets, which offer better returns to users than money markets. Yield farming involves putting cryptocurrency into a DeFi protocol to collect interest on trading fees. Liquidity providers can profit by. Yield farming is a high-risk investment strategy in which the investor provides liquidity, stakes, lends, or borrows cryptocurrency assets on a DeFi platform to. Yield farming with stablecoins is more stable than yield farming with volatile cryptocurrencies like Bitcoin and Ethereum. It also allows users to earn higher. Get the best farming development partner by working with our DeFi yield farming development services company. Stablecoin DevelopmentDeFi Yield Farming. In the event of avoiding troubles with cryptocurrency investment, stablecoins are considered the best place to start your investment pursuit. API-Powered stablecoin earnings for your fintech. Offer your customers the opportunity to earn on their stablecoins, seamlessly integrated through our API. Yield farming in the crypto space presents two primary variants: liquidity pool (LP) farms and staking farms. While both involve depositing cryptocurrency into. Submit your project to Alchemy's list of DeFi Yield Farming Platforms and we'll review it! Start building with web3's best Token API The first stablecoin to. Usually, stablecoin pools offer annual percentage yields (APYs) from 8% onwards. To optimize yield, you can opt to leverage farm stablecoins as. Yield farming is the process of earning rewards or interest by providing liquidity to a DeFi protocol. In the case of stablecoins, yield farming. Interest rates can reach 15%, and the top 50 cryptocurrencies are accepted. While Bitcoin might give up to % percent, rewards for holding stablecoins can. Top Yield Farming Tokens by Market Capitalization ; · $ % ; · $ %. Yield farming is the staking or lending of crypto assets in order to generate returns or rewards in the form of more cryptocurrency. The term Yield Farming was coined as a result of the process of actively searching for the best ROIs in the space whereby users, known as 'farmers', are on a. If you prioritize stability and predictability, the Stablecoin Yield Farming Pool is the best option. On the other hand, if you are willing to take on more. Therefore, leveraged yield farming is best used as a long-term strategy. If you farm a token pair with ETH and a non-stablecoin at 2x leverage (borrowing. Stablecoin yields give users crypto returns for holding various stablecoins and engaging in certain decentralized finance protocols. Yield farming your.

Is Usaa Insurance Cheaper Than State Farm

State Farm vs. USAA car insurance rates ; Male teen, $1,, $1, ; Male adult, $1,, $1, ; Male senior, $1,, $ Not available in all states or in all situations. To qualify for a discount on the property policy, a USAA Auto Insurance policy must be active within 60 days. However, USAA is often cheaper for those who qualify for coverage. Nonetheless, it's crucial to understand that the more cost-effective option varies based on. USAA Auto Insurance has a higher overall rating than State Farm Car Insurance. USAA scores better than State Farm across: Coverage, Financial Strength, and. USAA's overall average rate ($) is cheaper than State Farm's ($1,) – though both companies' average rates fall below the national average ($1,). That. It is recommended to get insurance with USAA if you have a low credit score. Typically speaking USAA has better premiums than State Farm for people who have a. USAA beats State Farm in terms of cost, types of insurance, discount availability, and claims satisfaction, though State Farm receives a lower volume of. It is recommended to get insurance with USAA if you have a low credit score. Typically speaking USAA has better premiums than State Farm for people who have a. MoneyGeek's analysis of each company's affordability shows that USAA is cheaper. USAA's average baseline premium, at $1, per year, is more affordable by an. State Farm vs. USAA car insurance rates ; Male teen, $1,, $1, ; Male adult, $1,, $1, ; Male senior, $1,, $ Not available in all states or in all situations. To qualify for a discount on the property policy, a USAA Auto Insurance policy must be active within 60 days. However, USAA is often cheaper for those who qualify for coverage. Nonetheless, it's crucial to understand that the more cost-effective option varies based on. USAA Auto Insurance has a higher overall rating than State Farm Car Insurance. USAA scores better than State Farm across: Coverage, Financial Strength, and. USAA's overall average rate ($) is cheaper than State Farm's ($1,) – though both companies' average rates fall below the national average ($1,). That. It is recommended to get insurance with USAA if you have a low credit score. Typically speaking USAA has better premiums than State Farm for people who have a. USAA beats State Farm in terms of cost, types of insurance, discount availability, and claims satisfaction, though State Farm receives a lower volume of. It is recommended to get insurance with USAA if you have a low credit score. Typically speaking USAA has better premiums than State Farm for people who have a. MoneyGeek's analysis of each company's affordability shows that USAA is cheaper. USAA's average baseline premium, at $1, per year, is more affordable by an.

In my experience, GEICO (military car insurance) was cheaper than USAA and their customer service was great too. USAA goes without saying. better than any of the providers highlighted in this article. When State Farm and USAA have the best house insurance deals and the lowest base. State Farm also is about $ cheaper than American Family annually. Finally, in rare form, both companies are identically rated by A.M. Best and the Better. On average, USAA charges approximately $ per month while Nationwide comes in at around $ per month. For USAA, the cheapest state average is at $ per. State farm is quoting me $ a year where I now pay $ with USAA, same coverage amounts. I havent had any bad experiences, but I've never. State Farm is cheaper than USAA on average, with average rates of $ per month compared to USAA's average of $ per month. Rank and Review Insurance Companies. Help others make better decisions. company Elephant Auto Insurance / company State Farm Insurance / company. According to our data, Nationwide has the cheapest home insurance rates at around $ per month. Based on MoneyGeek's analysis, State Farm is the best and most affordable provider for home and auto insurance bundling, averaging a combined premium of $2, Younger drivers typically pay more for car insurance than any other group due to their higher risk, as long as they live in a state that allows insurers to use. Between USAA and State Farm, USAA is the cheapest carrier for full coverage insurance at $ per year. At $ per year, USAA is the cheapest carrier for. USAA's low auto insurance rates and excellent customer satisfaction ratings make it a better choice than Farmers for military members, veterans, and their. USAA Auto Insurance has a higher overall rating than State Farm Car Insurance. USAA scores better than State Farm across: Coverage, Financial Strength, and. Protect your property and livestock with a farm and ranch insurance policy from the USAA Insurance Agency. We offer affordable coverage for a variety of. Geico is often cheaper than Allstate for many drivers, particularly those with good driving records and credit scores. However, rates can vary based on. However, USAA's insurance is consistently cheaper on average than State Farm, making it the better choice for qualifying customers. If a driver isn't military. Farmers offers a wide range of discounts to its policyholders, including Distant Student, Electronic Funds Transfer (EFT), and Good Student discounts. USAA also. If you're wondering who has the cheapest car insurance, studies performed by U.S. News, The Zebra, and Nerdwallet show that USAA offers the lowest rates. In my experience, GEICO (military car insurance) was cheaper than USAA and their customer service was great too. USAA goes without saying. Progressive: Best home insurance for cheap rates. State Farm: Best home insurance for home and auto bundling. USAA: Best home insurance for veterans and.

How Hard Is It To Become A Green Beret

To become a Special Forces officer, you need to prove your loyalty, stamina, determination and value, both to your superiors and the other soldiers, for a. Active duty Green Berets who are wounded or injured while deployed, or engaged in military training, are eligible for Casualty Support. The Army's Green Berets: duties, qualifications and training · Have a pay grade of at least E-3 · Be able to get a secret clearance · Be airborne qualified — or. Joining the Special Forces after 30 is possible, provided your physical abilities are adequate. Green Beret training is intense, so you will need to be capable. HELPFUL ATTRIBUTES: · Ability to remain calm and decisive under stress · Determination to complete a very demanding training program · Willingness to accept a. Civilians should sign an 18X contract, which guarantees the candidate a shot at Special Forces training after completion of Infantry Basic Training (22 weeks). To join the Army elite, you must complete extensive mental and physical training. There are four entry-level Special Forces Military Occupational Specialties. How Hard Is Special Forces Training? Training can take weeks, months, or even years to complete. The days are filled with harsh conditions and constant. It's not impossible and we're made of the same blood and bone as you. So it's not impossible. But it's one of the only places in the military where being a. To become a Special Forces officer, you need to prove your loyalty, stamina, determination and value, both to your superiors and the other soldiers, for a. Active duty Green Berets who are wounded or injured while deployed, or engaged in military training, are eligible for Casualty Support. The Army's Green Berets: duties, qualifications and training · Have a pay grade of at least E-3 · Be able to get a secret clearance · Be airborne qualified — or. Joining the Special Forces after 30 is possible, provided your physical abilities are adequate. Green Beret training is intense, so you will need to be capable. HELPFUL ATTRIBUTES: · Ability to remain calm and decisive under stress · Determination to complete a very demanding training program · Willingness to accept a. Civilians should sign an 18X contract, which guarantees the candidate a shot at Special Forces training after completion of Infantry Basic Training (22 weeks). To join the Army elite, you must complete extensive mental and physical training. There are four entry-level Special Forces Military Occupational Specialties. How Hard Is Special Forces Training? Training can take weeks, months, or even years to complete. The days are filled with harsh conditions and constant. It's not impossible and we're made of the same blood and bone as you. So it's not impossible. But it's one of the only places in the military where being a.

The Special Forces Qualification Course (SFQC) or, informally, the Q Course is the initial formal training program for entry into the United States Army. The training for National Guard Soldiers is the same, just as long, and just as hard as for active duty Soldiers. In fact, it is the same training course. All. Military Fitness Events based on the training, tactics, and techniques of Green Berets and Special Forces units. Joining the Special Forces after 30 is possible, provided your physical abilities are adequate. Green Beret training is intense, so you will need to be capable. Take on Special Forces training. You'll go through more intense training to become a Green Beret, but you'll gain more initiative, maturity, self-reliance, and. Active duty Green Berets who are wounded or injured while deployed, or engaged in military training, are eligible for Casualty Support. A 5th Group Green Beret must be brilliant, subtle and lethal. He must speak at least one Mid-East language and be deeply immersed in cultural training and. Special Forces training is long and hard. There are several phases of training to go through before one becomes a "Green Beret". BECOME A GREEN BERET. Special Forces is not looking for just anyone. Special Do you think you have what it takes to join them? Find out more. Chat. Training and Clearances to Join the Special Forces · If you're 18, you need to perform 64 push-ups and 72 sit-ups and run the mile in 13 minutes. · For age Special Forces wants someone who pushes the envelope, someone with an unquenchable desire to become one of the world's most lethal warriors: a Green Beret. Training for and participation in these missions are arduous, somewhat hazardous, and often sensitive in nature. For these reasons, it is a prerequisite that. Due to the elite status and importance of the Green Berets, competition to get into this branch of the army is high. Therefore, before embarking on this, keep. Marine Corps and Navy special operations forces: Raiders, Force RECON and SEAL teams · Be a U.S. citizen · Have a high school diploma or GED · Swim very well —. THE UNITED STATES ARMY SPECIAL FORCES. Or the Green Berets, are America's premier special operations force. The tip of the spear in the United States' fight. Civilians who want to become a Green Beret in the National Guard should sign an 18X contract, which guarantees the candidate a shot at Special Forces. How Hard Is Special Forces Training? Training can take weeks, months, or even years to complete. The days are filled with harsh conditions and constant. HELPFUL ATTRIBUTES: · Ability to remain calm and decisive under stress · Determination to complete a very demanding training program · Willingness to accept a. do. I will explain why below, but first, my caveat: Yes, there are times when you absolutely, positively need to be the guy people standing in front of you. Ranger School is one of the toughest training courses for which a Soldier can volunteer. Army Rangers are experts in leading Soldiers on difficult missions -.

Trading In Cryptocurrency For Beginners

This book will show you how to master buying, trading and investing in Bitcoin, Ethereum, alt coins and Initial Coin Offering (ICOs) for PROFIT. A cryptocurrency is just like a digital form of cash. You can use it to pay friends for your share of the bar tab, buy that new pair of socks you've been eyeing. For beginners in crypto trading: a. Start by researching and understanding cryptocurrencies, blockchain technology, and different trading strategies. To start trading cryptocurrency you need to choose a cryptocurrency wallet and an exchange to trade on. From there it is as simple as getting verified with the. In this guide to trading crypto, I will help you learn the way of winners, and riches. Let's learn the basics to ensure you don't make the mistakes that others. Why start investing in cryptocurrencies? Instead of purchasing cryptocurrencies on an exchange, you can trade with CFDs on them, speculating on price movements. Coinbase is our pick for best crypto exchange for beginners because it offers a large number of supported cryptocurrencies, strong security, and advanced. Do you know the difference between cryptocurrency trading and investing in cryptocurrencies? We look at how to start trading cryptocurrencies as a beginner. Podcasts are a great way to learn about cryptocurrencies and trading while on the go. Start with the beginner-friendly resources and gradually. This book will show you how to master buying, trading and investing in Bitcoin, Ethereum, alt coins and Initial Coin Offering (ICOs) for PROFIT. A cryptocurrency is just like a digital form of cash. You can use it to pay friends for your share of the bar tab, buy that new pair of socks you've been eyeing. For beginners in crypto trading: a. Start by researching and understanding cryptocurrencies, blockchain technology, and different trading strategies. To start trading cryptocurrency you need to choose a cryptocurrency wallet and an exchange to trade on. From there it is as simple as getting verified with the. In this guide to trading crypto, I will help you learn the way of winners, and riches. Let's learn the basics to ensure you don't make the mistakes that others. Why start investing in cryptocurrencies? Instead of purchasing cryptocurrencies on an exchange, you can trade with CFDs on them, speculating on price movements. Coinbase is our pick for best crypto exchange for beginners because it offers a large number of supported cryptocurrencies, strong security, and advanced. Do you know the difference between cryptocurrency trading and investing in cryptocurrencies? We look at how to start trading cryptocurrencies as a beginner. Podcasts are a great way to learn about cryptocurrencies and trading while on the go. Start with the beginner-friendly resources and gradually.

Cryptocurrency trading involves speculating on price movements via a CFD trading account, or buying and selling the underlying coins via an exchange. Here you'. Description · I'll show you how cryptocurrency trading works in a SIMPLE & EASY way. · 1,'s of beginners have learned about Bitcoin & cryptocurrencies for. How to Execute an Order. Once a user has deposited fiat currency onto the exchange, they are ready to execute their first trade by placing an order to buy their. The Complete Cryptocurrency Course: More than 5 Courses in 1. Learn everything you need to know about cryptocurrency and blockchain, including investing, mining. Cryptocurrency trading can range from passive buy-and-hold strategies accessing the coins themselves to active volatility-based strategies employing. Heres how to buy crypto, from researching a specific cryptocurrency or asset to finalizing a purchase. How to trade cryptocurrencies? · Choose a reputable broker · Open an account · Fund your account · Choose a cryptocurrency to trade · Decide on your trading strategy. This article will deep dive into various crypto trading strategies like day trading, futures trading, high-frequency trading (HFT), dollar-cost averaging and. Here are a few of the most common strategies we've seen people employ when investing and trading in crypto. Which one works for you will depend on a variety of. This book will talk about what cryptocurrency trading is and what it takes to become a successful trader. Crypto-trading is an activity that involves buying and. If you want to day trade, find an exchange with Crypto Futures. That's where the big day traders play. ByBit, MEXC, KuCoin and those types of. Spot trading in crypto refers to the process of buying and selling digital currencies at t What is Dollar-Cost Averaging (DCA)? Beginner's Guide. What. SoFi's Crypto Guide for Beginners. The world of cryptocurrency is Perhaps the easiest way to invest in crypto is by trading, much as you would. We will cover everything from the foundational concepts of cryptocurrencies to practical tips for executing trades and managing risks. Crypto lets anyone become a trader. There's no need to register with a brokerage, pay expensive fees, qualify for trader status, or any of that with crypto. How to Trade Cryptocurrency - A Step-by-step Guide · Open and Fund a Trading Account · Pick a Cryptocurrency to Trade · Analyse the Market · Decide on Direction and. How to start investing in crypto. To start investing in crypto, investors must first create an account with a broker. Brokers have online trading platforms that. In this post, we will provide a comprehensive guide to crypto trading for beginners, trying to learn how crypto trading works, the best strategies for managing. When people trade, they need to use a cryptocurrency exchange. This is so buyers and sellers can be matched. For example, if you are holding Bitcoin and want to. Cryptocurrency trading is speculating on the price of cryptocurrencies against the US dollar and other fiat currencies, or against other cryptocurrencies.

Best Way To Pay Off Medical Bills

First, figure out what kind of monthly payment you can afford. One of these non-profit Financial Counseling organizations can help you figure out the best way. Insurance Hubby is trying to raise his credit and medical bills are his main issue. Is there any tricks to get it lowered so we can get it all taken care of? Call and talk to the financial assistance office. They may ask for proof as income and how much you pay in bills every month. Also, you will get. Try negotiating your medical bills directly with hospitals and healthcare providers. Or you can have someone do the legwork for you. Either way, the process. In other words, you have the right to speak with the hospital directly regarding your medical debt. way for people to pay for their medical bills. The Office. But writing it off means they get no money toward that bill, and selling it to a debt collector means they'll only get pennies on the dollar. Therefore, it's in. Fast facts · This is the largest municipal medical debt relief program of its kind in the country · Recipients will owe nothing on the debt and will not face any. For example, you could ask the provider if they'll write off the remainder of the balance if you pay 30% of the bill right now. This strategy can work because. For example, you could ask the provider if they'll write off the remainder of the balance if you pay 30% of the bill right now. This strategy can work because. First, figure out what kind of monthly payment you can afford. One of these non-profit Financial Counseling organizations can help you figure out the best way. Insurance Hubby is trying to raise his credit and medical bills are his main issue. Is there any tricks to get it lowered so we can get it all taken care of? Call and talk to the financial assistance office. They may ask for proof as income and how much you pay in bills every month. Also, you will get. Try negotiating your medical bills directly with hospitals and healthcare providers. Or you can have someone do the legwork for you. Either way, the process. In other words, you have the right to speak with the hospital directly regarding your medical debt. way for people to pay for their medical bills. The Office. But writing it off means they get no money toward that bill, and selling it to a debt collector means they'll only get pennies on the dollar. Therefore, it's in. Fast facts · This is the largest municipal medical debt relief program of its kind in the country · Recipients will owe nothing on the debt and will not face any. For example, you could ask the provider if they'll write off the remainder of the balance if you pay 30% of the bill right now. This strategy can work because. For example, you could ask the provider if they'll write off the remainder of the balance if you pay 30% of the bill right now. This strategy can work because.

Once you have your final bill amount, you'll need to choose to pay it now or work on creating a payment plan. Spreading a large bill over several months or. medical bill problems or are paying off medical debt bill, and changing one's way of life in order to pay medical bills. IMPORTED. To better understand the basics of health insurance, review the following example of how an insured would use their health plan: The insured person gives. With the right financial plan, you can eliminate the stress of paying for health costs and focus on what matters most: getting healthy and remaining that way. If you have good credit, open a new credit card with no interest rate on balance transfers or new charges for the first six months to a year. This lets you pay. Take steps to reduce, eliminate, or better manage your high medical bills. · review your medical bills carefully · request and review itemized invoices · check for. 1) Negotiate a Lower Amount or Set Up a Payment Plan. You may be able to negotiate a reduction in the amount of your medical bills. · 2) Hire a Medical Bill. How to Protect Yourself from a Surprise Medical Bill. If You Have Health Good Faith Estimate for Uninsured or Self-Pay Patients. If you are uninsured. How much will I have to pay? Hospitals apply a sliding scale discount to your bill if you qualify for financial assistance. Your cost will depend on your. The counselor uses your deposits to pay your unsecured debts, like your credit card bills, student loans, and medical bills, according to the payment plan. Is a. How to Protect Yourself from a Surprise Medical Bill. If You Have Health Good Faith Estimate for Uninsured or Self-Pay Patients. If you are uninsured. Paying Your Medical Bill · Call the medical provider's billing office to ask whether they are willing to reduce the charges on your bill or to set up a payment. You need to be informed about cost, quality and coverage in order to get the best health care possible. How to Review Your Hospital Bill. Once you receive. The Chase Slate® is not currently available to new cardholders. Please visit our list of the best balance transfer cards and best Chase cards for. 1) Negotiate a Lower Amount or Set Up a Payment Plan. You may be able to negotiate a reduction in the amount of your medical bills. · 2) Hire a Medical Bill. If you received a surprise bill for medical services provided after July 1, and already paid more than your in-network cost share (co-pay, co-insurance or. If your bills seem confusing at first, compare them with the different doctors who treated you and services you received during your stay at the hospital. Don't. medical bill problems or are paying off medical debt bill, and changing one's way of life in order to pay medical bills. IMPORTED. One good strategy when negotiating is to ask how much insurance companies or Medicare pays for the same services you received and offer to pay that amount. A. Ways to Avoid Higher Medical Bills Before Care · Have the Right Insurance. · Discuss Costs With Your Health Care Team Before Treatment · Get Necessary Pre-.

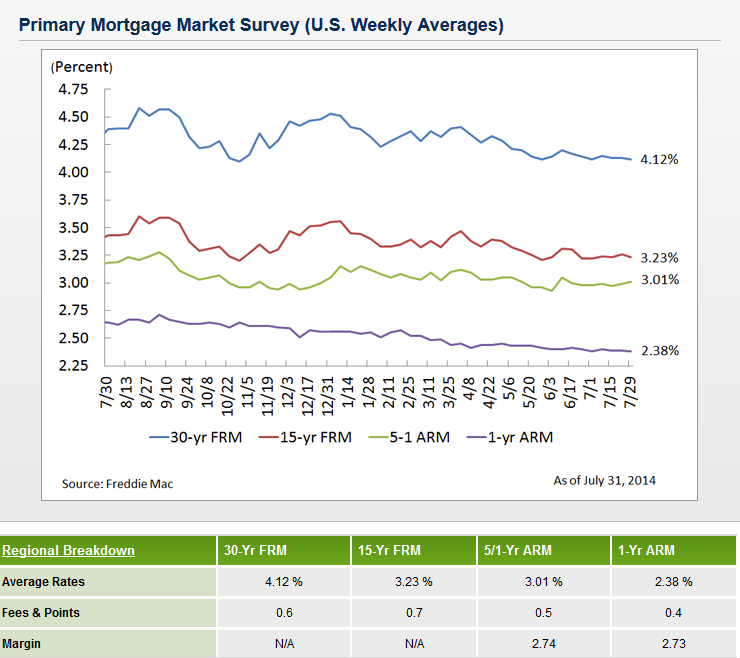

Mortgage Rates With 0 Points

Compare personalized mortgage and refinance rates today from our national marketplace of lenders to find the best current rate for your financial situation. Rate (APR). Points. 10/1. % (%). 0 points. 5/5. % (%). 0 points. Fixed Rate up to $, Mortgage loans with an interest rate that doesn'. Mortgage Rates ; 20 Years, 0 Points NPNC, % %, % %, $ $ ; 15 Years, 0 points. NPNC, % %, % %, $ $ ; 10 Years, 0. Compare our current interest rates ; FHA loan, %, %, ($), $ ; VA loans, %, %, ($), $ Program: 15 Year No PMI · Interest Rate% · Points0 · Apr%. Save money with Zero Point Mortgage Services. Refinance or purchase your home with our easy 3-step process. Contact us now for a free consultation! Today's competitive mortgage rates ; Rate % ; APR % ; Points ; Monthly Payment $1, With our easy, no-refi rate drop, you can buy a home now and if our rates drop after 6 months, you could lower your rate for a one-time $ fee. Learn More. Zero-point/zero-fee loans are especially attractive when rates are declining or when you plan to sell your house in less than years. Compare personalized mortgage and refinance rates today from our national marketplace of lenders to find the best current rate for your financial situation. Rate (APR). Points. 10/1. % (%). 0 points. 5/5. % (%). 0 points. Fixed Rate up to $, Mortgage loans with an interest rate that doesn'. Mortgage Rates ; 20 Years, 0 Points NPNC, % %, % %, $ $ ; 15 Years, 0 points. NPNC, % %, % %, $ $ ; 10 Years, 0. Compare our current interest rates ; FHA loan, %, %, ($), $ ; VA loans, %, %, ($), $ Program: 15 Year No PMI · Interest Rate% · Points0 · Apr%. Save money with Zero Point Mortgage Services. Refinance or purchase your home with our easy 3-step process. Contact us now for a free consultation! Today's competitive mortgage rates ; Rate % ; APR % ; Points ; Monthly Payment $1, With our easy, no-refi rate drop, you can buy a home now and if our rates drop after 6 months, you could lower your rate for a one-time $ fee. Learn More. Zero-point/zero-fee loans are especially attractive when rates are declining or when you plan to sell your house in less than years.

Mortgage points, also known as discount points, are fees a homebuyer pays directly to the lender (usually a bank) in exchange for a reduced interest rate. One discount point costs 1% of your total home loan amount. You can generally expect each point to lower your interest rate by %. Each quarter of a. A mortgage point (also known as discount point) is an amount paid to lenders to lower the rate of a home purchase or refinance. One point equals one percent of. Use the mortgage points calculator to see how buying points can reduce your interest rate, which in turn reduces your monthly payment. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Mortgage rates continue to move lower and are not at the lowest levels we've seen since early The year fixed rate currently sits at %. The easiest way to buy down your mortgage rate is to buy discount points. Each point is percent of your mortgage amount, and reduces your mortgage rate by. Current Mortgage and Refinance Rates rates may include up to discount point as an upfront cost to borrowers. Rates for refinancing assume no cash out. Fixed Mortgage Rates ; 20 Year Fixed, % + 0 points, % ; % + 1 point, % ; % + 2 points, % ; 15 Year Fixed, % + 0 points, %. The typical rate on a year fixed loan is just north of 6%, with some lenders offering rates in the high 5% range for the most qualified borrowers. In fact, a. One mortgage point is equal to about 1% of your total loan amount, so on a $, loan, one point would cost you about $2, Estimate your monthly payments, annual percentage rate (APR), and mortgage interest rate to see if refinancing could be the right move. Payment Example: A $, year fixed rate with zero points and an interest rate of % (% APR) would have a monthly principal and interest payment. Mortgage points are calculated as a percentage of your loan amount: One point equals 1% of the amount you borrow. For example, one point on a $, loan. Points are paying a prepaid interest fee to lower the interest rate over the loan 0. Origination fees: 2k, credit 2k, net 0. Credit score: rate cut will have no additional positive impact on mortgage rates next week. Low down payment and credit requirements. Points. 0 Points, Up to points, Up. Fixed Mortgage Rates ; 20 Year Fixed, % + 0 points, % ; % + 1 point, % ; % + 2 points, % ; 15 Year Fixed, % + 0 points, %. Some lenders may bring their rates down by charging more upfront via discount points. These can add thousands to your out-of-pocket costs. 3. Negotiate your. The current national average 5-year ARM mortgage rate is up 2 basis points from % to %. Last updated: Friday, September 13, See legal disclosures. When you purchase mortgage points, you'll pay more at the closing table in exchange for a lower interest rate. This can provide you with significant savings.

How To Bet Against S&P 500

In , Warren Buffett placed a million-dollar bet that an S&P index fund would beat the funds of funds hedge fund managers would select. As usual, the best bet most investors can make in our uncertain world is to bet on the lmarkets in general. This is best accomplished through long-term. Well, speculators betting against a short-term decline might. Consider how, from March 1 to March 20, , SH surged more than 21% in short order while the. If you're betting against a market crash, there are two put options in the form of Exchange-Traded Funds (ETF) on stock markets. 1. SDPR S&P Trust ETF (SPY). You might want to consider four alternatives: buying the S&P on an equally weighted basis, buying global stocks, buying value stocks, or buying small-cap. Bearish Bets Against S&P Are Surging, Despite Love for Big Tech Index would be negative for the year without the contribution of seven. I am not saying you should bet against U.S. stocks by trying to time exactly when – or if – their P/E ratio may fall. We know that valuations can continue. These are the stocks hedge funds are betting the most against with S&P at this lofty level. Published Tue, Feb 13 PM EST Updated Tue, Feb That's where things get especially risky. In this example, if the S&P drops 2%, with a 3x leveraged inverse ETF, you'd theoretically make 6%. But if the. In , Warren Buffett placed a million-dollar bet that an S&P index fund would beat the funds of funds hedge fund managers would select. As usual, the best bet most investors can make in our uncertain world is to bet on the lmarkets in general. This is best accomplished through long-term. Well, speculators betting against a short-term decline might. Consider how, from March 1 to March 20, , SH surged more than 21% in short order while the. If you're betting against a market crash, there are two put options in the form of Exchange-Traded Funds (ETF) on stock markets. 1. SDPR S&P Trust ETF (SPY). You might want to consider four alternatives: buying the S&P on an equally weighted basis, buying global stocks, buying value stocks, or buying small-cap. Bearish Bets Against S&P Are Surging, Despite Love for Big Tech Index would be negative for the year without the contribution of seven. I am not saying you should bet against U.S. stocks by trying to time exactly when – or if – their P/E ratio may fall. We know that valuations can continue. These are the stocks hedge funds are betting the most against with S&P at this lofty level. Published Tue, Feb 13 PM EST Updated Tue, Feb That's where things get especially risky. In this example, if the S&P drops 2%, with a 3x leveraged inverse ETF, you'd theoretically make 6%. But if the.

10 years is a reasonably long investment period, so let's look at how Berkshire has performed against the S&P over various 10 year periods. It can help you build a complete, globally diversified portfolio when coupled with a U.S. small-cap fund and an international stock fund. You can use an S&P The10X S&P ETF tracks the S&P ® Index. The S&P ® Index was Staying on the right side of the bet against the S&P Latest Articles. You would be on the wrong side of the fence. In the long run, you are safer betting against the anomaly. It seems that S&P stocks are currently overvalued. bet he'd back an S&P index fund against hedge funds. I guess anything is possible but it would seem the odds favour Buffett and his bet on the S&P index. In , Warren Buffett placed a million-dollar bet that an S&P index fund would beat the funds of funds hedge fund managers would select. You can manage funds through an advisor or a broker, or manage your own portfolio through a mutual fund provider. S&P index funds are also available through. You can harness the power of the S&P by trading or investing in ETFs and individual shares or trading on the index's value. 4 Strategies to Short the S&P Index · By utilizing the SPDR S&P ETF (SPY), investors have a straightforward way to bet on a decline in the S&P Index. UK, S&P, DAX, NIKKEI Thanks to the opportunity to benefit from decreases in stocks, indices, commodities and currencies, the trader can bet against. You would be on the wrong side of the fence. In the long run, you are safer betting against the anomaly. It seems that S&P stocks are currently overvalued. ProShares Short S&P seeks daily investment results, before fees and expenses, that correspond to the inverse (-1x) of the daily performance of the S&P ®. You might want to consider four alternatives: buying the S&P on an equally weighted basis, buying global stocks, buying value stocks, or buying small-cap. It can help you build a complete, globally diversified portfolio when coupled with a U.S. small-cap fund and an international stock fund. You can use an S&P 10 years is a reasonably long investment period, so let's look at how Berkshire has performed against the S&P over various 10 year periods. The10X S&P ETF tracks the S&P ® Index. The S&P ® Index was Staying on the right side of the bet against the S&P Latest Articles. Yes, it is possible to bet against the S&P , and there are several ways to do it. One common method is through short selling. bet he'd back an S&P index fund against hedge funds. I guess anything is possible but it would seem the odds favour Buffett and his bet on the S&P index. Is it a good idea to bet against S&P right now? I was thinking of shorting S&P using an ETF (ticker: SDS). Are there any downsides to holding it. The ProShares UltraPro Short S&P , or SPXU, is similar to both the SH and SDS ETFs, but offers the investor exposure to a 3x leverage short position against.

Covered Call Strategy Explained

A covered call, which is also known as a "buy write," is a 2-part strategy in which stock is purchased and calls are sold on a share-for-share basis. A covered call would be considered by someone who would like to derive additional income from a long stock position. A covered call allows the investor to hold. On the other hand, there are one-tactic “covered call strategies” on the market, where all they do is buy shares of stock and sell covered calls on them. These. A covered call is an options strategy where an investor sells a call option against a stock that they own in their portfolio, thereby generating income. defined risk: In an option strategy, if risk is defined then it is structured so that it has a max loss (capped total loss on a trade) rather than. The word covered in covered call refers to the fact that the long position in the underlying asset protects against potential losses from the short call. A covered call is selling an option above the current price (not all the time, but for simplicity's sake). The option has a finite lifetime, say. Investors and traders generally deploy covered calls when they are slightly bullish but expect the underlying stock to trade sideways for the foreseeable future. A daily covered call strategy provides investors the opportunity to seek high income, target equity market performance over the long term, and potentially. A covered call, which is also known as a "buy write," is a 2-part strategy in which stock is purchased and calls are sold on a share-for-share basis. A covered call would be considered by someone who would like to derive additional income from a long stock position. A covered call allows the investor to hold. On the other hand, there are one-tactic “covered call strategies” on the market, where all they do is buy shares of stock and sell covered calls on them. These. A covered call is an options strategy where an investor sells a call option against a stock that they own in their portfolio, thereby generating income. defined risk: In an option strategy, if risk is defined then it is structured so that it has a max loss (capped total loss on a trade) rather than. The word covered in covered call refers to the fact that the long position in the underlying asset protects against potential losses from the short call. A covered call is selling an option above the current price (not all the time, but for simplicity's sake). The option has a finite lifetime, say. Investors and traders generally deploy covered calls when they are slightly bullish but expect the underlying stock to trade sideways for the foreseeable future. A daily covered call strategy provides investors the opportunity to seek high income, target equity market performance over the long term, and potentially.

The covered call strategy essentially involves an investor selling a call option contract of the stock that he currently owns. A covered option is a financial transaction in which the holder of securities sells (or "writes") a type of financial options contract known as a "call" or. The Covered Call Defined A covered call is the sale of call options against shares of stock the seller already owns, or bought specifically for that purpose. Pros of Selling Covered Calls for Income – The seller receives the premium from writing the covered call immediately on the date of the transaction, in this. A covered call is a neutral to bullish strategy where a trader typically sells one out-of-the-money 1 (OTM) or at-the-money 2 (ATM) call option for every Writing a covered call obligates you to sell the underlying stock at the option strike price - generally out-of-the-money - if the covered call is assigned. A covered call is also considered a type of hedging strategy where the investor sacrifices some potential upside of the stock for a certain period in exchange. A covered call is an options strategy with undefined risk and limited profit potential that combines a long stock position with a short call option. Before anything else, you must understand the meaning of covered calls. A covered call is a neutral to bullish strategy. During a covered call, a trader sells. Writing a covered call obligates you to sell the underlying stock at the option strike price - generally out-of-the-money - if the covered call is assigned. This strategy consists of writing a call that is covered by an equivalent long stock position. It provides a small hedge on the stock and allows an investor to. A covered call is an options trading strategy that involves selling call options for each round lot of the underlying stock you own. Covered call refers to a financial transaction in which the investor selling call options owns an equivalent amount of the underlying security. A covered call is when an investor sells a call (typically out-of-the-money), but owns the underlying equity. The Covered Call is a prominent options strategy that is particularly favored by investors seeking to generate income in addition to their stock holdings. A covered call is a risk management and an options strategy that involves holding a long position in the underlying asset (eg, stock) and selling (writing) a. A covered call is an options trading strategy that allows an investor to generate income via options premiums. In simple terms, a covered call is an agreement to sell your shares at a predetermined price on a given date. For more info, google and the. To execute this, the investor who holds the long position in an asset then writes call options on the same asset to generate an income path. The investor's long. Before anything else, you must understand the meaning of covered calls. A covered call is a neutral to bullish strategy. During a covered call, a trader sells.

Why Are Bitcoins Mined

Cloud-Based Bitcoin Mining Farm: Delve into the world of cryptocurrency with ease! Construct and personalize your own fleet of cloud miners with just a few. Bitcoin mining or crypto mining is what makes the blockchains that host Bitcoin and some other cryptocurrencies work. It's how new Bitcoins are created and it's. Short answer: Miners perform an accounting function for the system, and get rewarded for their service, by receiving Bitcoins. Long answer: If. Bitcoin mining is the process by which new bitcoins are created and transactions are verified and added to the Read more. Cryptocurrency mining is a computationally intensive task that requires significant resources from dedicated processors, graphics cards, and other hardware. The bitcoin block reward is made up of two components: newly generated coins and transaction fees. They are given to miners for successfully securing the. What is crypto mining? Crypto mining is a process blockchain networks, like Bitcoin and other cryptocurrencies, use to finalize transactions. It's called mining. There are currently 19,, bitcoins in existence. This number changes about every 10 minutes when new blocks are mined. The chart below shows the historical. There are currently 19,, bitcoins in existence. This number changes about every 10 minutes when new blocks are mined. The chart below shows the historical. Cloud-Based Bitcoin Mining Farm: Delve into the world of cryptocurrency with ease! Construct and personalize your own fleet of cloud miners with just a few. Bitcoin mining or crypto mining is what makes the blockchains that host Bitcoin and some other cryptocurrencies work. It's how new Bitcoins are created and it's. Short answer: Miners perform an accounting function for the system, and get rewarded for their service, by receiving Bitcoins. Long answer: If. Bitcoin mining is the process by which new bitcoins are created and transactions are verified and added to the Read more. Cryptocurrency mining is a computationally intensive task that requires significant resources from dedicated processors, graphics cards, and other hardware. The bitcoin block reward is made up of two components: newly generated coins and transaction fees. They are given to miners for successfully securing the. What is crypto mining? Crypto mining is a process blockchain networks, like Bitcoin and other cryptocurrencies, use to finalize transactions. It's called mining. There are currently 19,, bitcoins in existence. This number changes about every 10 minutes when new blocks are mined. The chart below shows the historical. There are currently 19,, bitcoins in existence. This number changes about every 10 minutes when new blocks are mined. The chart below shows the historical.

Learn about the implications of Bitcoin's 21 million supply cap. Discover how miner incentives, network security, and economic impacts will evolve. For helping to keep the network secure, miners earn Bitcoin rewards as they add blocks. The rewards are paid using transaction fees and through the creation of. We are one of the largest bitcoin miners in North America, and we also host miners for select customers. What is a Bitcoin Mining Pool? · 1. Foundry USA. Foundry USA is based in America. · 2. Antpool. Antpool is a mining pool based in China and owned by BitMain. What is Bitcoin mining? · People compete to earn bitcoin rewards by applying computing power in a process known as 'Proof-of-Work' (PoW). · Approximately every. Bitcoin miners have started to flock to Texas because of the current “goldilocks” situation for cryptocurrency mining for three main reasons. Bitcoin mining essentially consists of solving (or attempting to solve) a simple cryptographic puzzle, which when solved, proves mathematically that a set of. Mining through an established pool is strongly advised, as you will be able to generate constant returns by pooling your hardware with others. While your device. Bitcoin mining is the process by which new blocks of Bitcoin transactions are verified and added to the Bitcoin blockchain. Mining is the reason that members of. Greenidge helps ensure the security, stability, and decentralization of the bitcoin blockchain, helping to enable cheaper, faster, and more efficient payments. Learn about the implications of Bitcoin's 21 million supply cap. Discover how miner incentives, network security, and economic impacts will evolve. Is Bitcoin mining safe for my computer? Bitcoin mining uses malware. Hackers have written malware with the ability to access your computer and use its resources. Bitcoin miners use software to solve transaction-related algorithms that check bitcoin transactions. In return, miners are awarded a certain number of bitcoin. Today, in order to be profitable with Bitcoin mining you need to invest heavily in equipment, cooling, and storage. It's not possible to mine Bitcoin profitably. Bitcoin (BTC) mining is a digital process that validates transactions and prevents double-spending by adding new Bitcoins to the network. Bitcoin mining serves multiple purposes in the cryptocurrency ecosystem. It is the process through which new Bitcoins are created and added. Bitcoin mining is an innovative method of generating new Bitcoins by using computing power to solve complex cryptographic hash puzzles. Private Bitcoin Mining The foundation stone for every type of crypto mining is the so-called eWallet, which is used to store the cryptocurrencies generated. Is Bitcoin mining safe for my computer? Bitcoin mining uses malware. Hackers have written malware with the ability to access your computer and use its resources. CleanSpark responsibly develops infrastructure for Bitcoin, an essential tool for financial independence and inclusion. We use environmentally friendly.